Value investing sets the stage for this enthralling narrative, offering readers a glimpse into a story rich in detail and brimming with originality from the outset. Get ready to dive into the world of investing with a unique twist that’s sure to keep you hooked.

As we explore the concept of value investing, fundamental analysis, margin of safety, long-term perspective, and contrarian investing, you’ll discover the keys to success in the stock market jungle.

What is Value Investing?

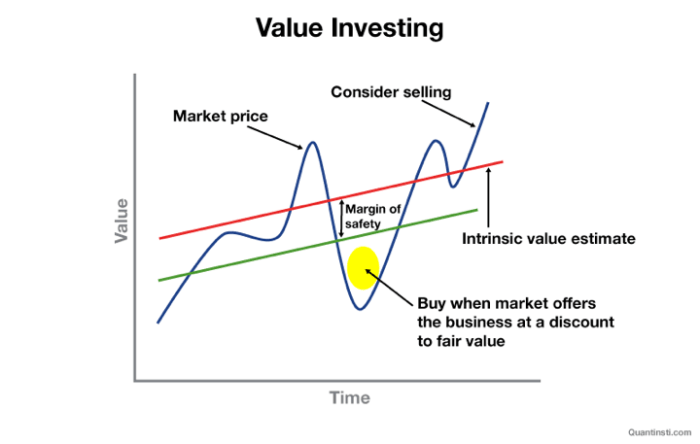

Value investing is a strategy where investors look for stocks that are trading below their intrinsic value. The goal is to find companies that are undervalued by the market and have the potential for long-term growth.

Principles of Value Investing

- Buy low, sell high: Value investors seek to buy stocks when they are trading below their intrinsic value, allowing them to profit when the market realizes the true worth of the company.

- Margin of safety: Value investors look for a margin of safety, which means buying stocks at a significant discount to their intrinsic value to protect against downside risk.

- Long-term perspective: Value investing is focused on the long-term prospects of a company, rather than short-term market fluctuations.

Examples of Well-Known Value Investors

- Warren Buffett: Known as one of the most successful value investors of all time, Warren Buffett follows the principles of value investing and has built a fortune through his investment strategy.

- Benjamin Graham: Considered the father of value investing, Benjamin Graham’s book “The Intelligent Investor” laid the foundation for the principles of value investing.

- Seth Klarman: Seth Klarman is a value investor known for his disciplined approach to investing and his focus on intrinsic value.

Fundamental Analysis in Value Investing

Fundamental analysis plays a crucial role in value investing by focusing on the intrinsic value of a stock rather than just its market price. This approach involves evaluating the financial health and performance of a company to determine its true worth.

Evaluating Intrinsic Value of a Stock

To evaluate the intrinsic value of a stock, investors often use discounted cash flow (DCF) analysis. This method involves estimating the future cash flows of a company and discounting them back to their present value. By comparing the intrinsic value calculated through DCF analysis with the current market price, investors can determine whether a stock is undervalued or overvalued.

Key Financial Ratios Used in Value Investing

- Price-to-Earnings (P/E) Ratio: This ratio compares a company’s stock price to its earnings per share, indicating how much investors are willing to pay for each dollar of earnings.

- Price-to-Book (P/B) Ratio: The P/B ratio compares a company’s market value to its book value, providing insight into whether a stock is undervalued or overvalued based on its assets.

- Debt-to-Equity Ratio: This ratio measures a company’s financial leverage by comparing its debt to its equity. A lower debt-to-equity ratio is generally preferred as it indicates lower financial risk.

- Return on Equity (ROE): ROE measures a company’s profitability by evaluating how effectively it generates profit from shareholders’ equity.

- Dividend Yield: This ratio indicates the percentage of a company’s dividend relative to its stock price, offering insight into the income potential for investors.

Margin of Safety

In value investing, the concept of margin of safety is crucial for minimizing the risks associated with investments and maximizing potential returns. It is essentially a buffer that protects investors from unforeseen events or errors in their analysis.

Calculation and Application of Margin of Safety

The margin of safety is calculated by finding the difference between the intrinsic value of a stock and its market price. This intrinsic value is determined through fundamental analysis, considering factors such as earnings, growth potential, and industry trends. Once the intrinsic value is estimated, subtracting the current market price provides the margin of safety.

Margin of Safety = Intrinsic Value – Current Market Price

Investors typically look for stocks with a significant margin of safety, indicating that the stock is undervalued and has room for price appreciation. By purchasing stocks with a margin of safety, investors can protect themselves from market fluctuations and uncertainties, potentially leading to higher returns in the long run.

Importance of Margin of Safety in Investment Decisions

Having a margin of safety is essential in investment decisions as it provides a cushion against potential losses. It allows investors to buy stocks at a discount to their intrinsic value, reducing the risk of capital erosion in case of adverse market conditions.

- Helps in managing risk: By investing in stocks with a margin of safety, investors can protect their capital and minimize the impact of market volatility.

- Provides a margin for error: Even if the initial analysis is slightly off, having a margin of safety ensures that investors are still in a favorable position.

- Enhances long-term returns: Stocks purchased with a margin of safety have the potential for significant upside as the market eventually recognizes their true value.

Long-Term Perspective in Value Investing

When it comes to value investing, having a long-term perspective is crucial for achieving success. This approach involves looking beyond short-term market fluctuations and focusing on the intrinsic value of an asset over time. By holding onto undervalued assets for the long term, investors can reap several benefits and potentially maximize their returns.

Benefits of Holding onto Undervalued Assets

- One of the key benefits of holding onto undervalued assets for the long term is the potential for significant capital appreciation. As the market eventually recognizes the true value of the asset, its price is likely to increase, leading to substantial gains for the investor.

- Long-term investors also benefit from the power of compounding. By reinvesting dividends or profits back into the asset over time, investors can accelerate their wealth accumulation and achieve exponential growth.

- Additionally, holding onto undervalued assets for the long term allows investors to avoid the emotional pitfalls of short-term trading, such as panic selling during market downturns. This disciplined approach can help investors stay focused on their investment thesis and ride out temporary market fluctuations.

Successful Long-Term Value Investing Strategies

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

- Warren Buffett, one of the most successful value investors of all time, is known for his long-term perspective and commitment to holding onto undervalued assets for years, if not decades. His investment in Coca-Cola in the 1980s is a prime example of his patient approach, as the stock has delivered exceptional returns over time.

- Another successful long-term value investing strategy is the buy-and-hold approach, where investors purchase undervalued assets with strong fundamentals and hold onto them regardless of short-term market fluctuations. This strategy requires discipline, patience, and a deep understanding of the underlying business.

- Successful value investors also focus on identifying companies with durable competitive advantages, known as economic moats, that can protect their long-term profitability and market share. By investing in such companies at attractive valuations and holding onto them for the long term, investors can generate significant wealth over time.

Contrarian Investing

Contrarian investing is a strategy where investors go against the prevailing market sentiment. It involves identifying opportunities in assets that are undervalued or overvalued by the market. Contrarian investors believe that the market often overreacts to news or events, creating mispricings that can be exploited for profit.

Differing from General Market Sentiment

Contrarian investors differ from the general market sentiment by looking for opportunities when others are fearful and selling, or when others are overly optimistic and buying. They take a long-term view and are not swayed by short-term market fluctuations or trends. Contrarian investors are willing to go against the crowd and have the conviction to hold their positions even when the market moves against them.

Strategies for Identifying Opportunities

- Value Discrepancies: Contrarian investors look for assets that are trading at a significant discount to their intrinsic value. They believe that these assets will eventually revert to their true value.

- Market Sentiment Indicators: Monitoring sentiment indicators such as the put/call ratio, investor surveys, and short interest can help contrarian investors gauge market sentiment and identify potential turning points.

- Contrarian Screening: Using screening tools to find stocks that are unpopular or out of favor with analysts or the market can uncover opportunities for contrarian investors.

- Margin of Safety: Just like in value investing, contrarian investors also emphasize the importance of a margin of safety. By buying assets at a discount to their intrinsic value, they protect themselves from potential downside risk.