Buckle up, folks! The world of credit scores and loans is about to get a whole lot more interesting. Today, we dive into the intricate web of financial decisions impacted by credit scores, revealing the hidden truths and strategies that can make or break your loan applications. Get ready for a wild ride through the world of credit and loans!

Now, let’s delve deeper into this fascinating topic and uncover the secrets behind credit scores and their profound impact on loans.

Importance of Credit Scores

Having a good credit score is crucial when applying for loans. Your credit score reflects your creditworthiness and financial responsibility, which lenders use to determine if you are a reliable borrower.

Impact on Loan Approval Rates

When you have a high credit score, you are more likely to get approved for a loan. Lenders see you as less risky and are more confident in your ability to repay the borrowed amount.

Influence on Interest Rates

Your credit score also affects the interest rates you are offered on loans. A higher credit score can lead to lower interest rates, saving you money over the life of the loan. On the other hand, a lower credit score may result in higher interest rates, costing you more in the long run.

Factors Affecting Credit Scores

When it comes to determining credit scores, several key factors play a crucial role in shaping an individual’s creditworthiness. These factors can have a significant impact on the ability to secure loans and favorable interest rates.

Payment History

Your payment history is one of the most important factors that influence your credit score. Lenders want to see a consistent track record of on-time payments, as this demonstrates reliability and responsibility. Missing payments or making late payments can have a negative impact on your credit score, indicating potential financial risk to lenders. It is essential to prioritize timely payments to maintain a positive payment history.

Credit Utilization Ratio

The credit utilization ratio is another critical factor that affects credit scores. This ratio measures the amount of credit you are using compared to the total amount of credit available to you. A high credit utilization ratio, where you are using a large percentage of your available credit, can signal financial strain and may lower your credit score. It is advisable to keep your credit utilization ratio below 30% to maintain a healthy credit score and demonstrate responsible credit management.

Types of Loans Influenced by Credit Scores

When it comes to loans, credit scores can have a significant impact on the terms and conditions you are offered. Let’s take a look at the types of loans where credit scores play a crucial role.

Impact of Credit Scores on Mortgage Loans

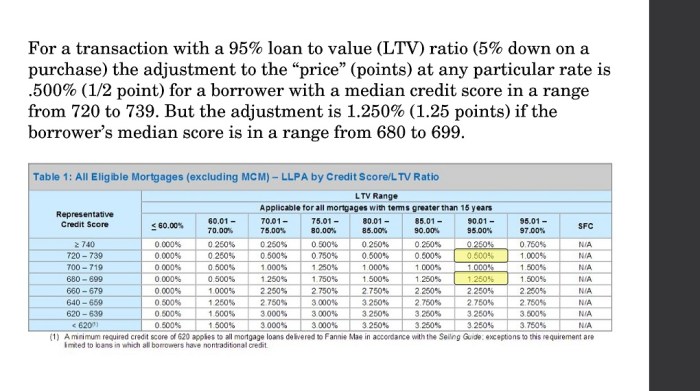

Mortgage loans are one of the biggest financial commitments most people will make in their lifetime. Your credit score plays a vital role in determining whether you qualify for a mortgage and what interest rate you will be offered. A higher credit score can help you secure a lower interest rate, saving you thousands of dollars over the life of the loan. On the other hand, a lower credit score may result in higher interest rates or even denial of the loan altogether.

How Credit Scores Affect Auto Loans and Personal Loans

Credit scores also play a crucial role in determining the terms of auto loans and personal loans. Lenders use your credit score to assess your creditworthiness and determine the interest rate you will be charged. A good credit score can help you secure a lower interest rate on your auto loan, saving you money over the term of the loan. Similarly, when applying for a personal loan, a higher credit score can increase your chances of approval and help you secure more favorable terms. On the other hand, a lower credit score may result in higher interest rates or even denial of the loan.

Strategies to Improve Credit Scores for Better Loan Terms

Improving your credit score is crucial to securing better loan terms and interest rates. By following these strategies, you can boost your credit score and increase your chances of getting approved for loans.

Pay off Existing Debt

One of the most effective ways to improve your credit score is to pay off existing debt. Focus on high-interest debts first and work towards paying off the balances in full. This will reduce your overall credit utilization and demonstrate responsible financial behavior.

Monitor Credit Utilization

Keep a close eye on your credit utilization ratio, which is the amount of credit you are using compared to your total available credit. Aim to keep this ratio below 30% to show lenders that you are using credit responsibly. Consider increasing your credit limits or paying down balances to lower your utilization ratio.

Make Timely Payments

Paying your bills on time is one of the most important factors in determining your credit score. Set up automatic payments or reminders to ensure that you never miss a payment. Late payments can significantly impact your credit score, so it’s crucial to prioritize timely payments.

Regularly Check Your Credit Report

Monitoring your credit report regularly can help you identify any errors or fraudulent activity that may be impacting your credit score. Dispute any inaccuracies and work towards resolving any outstanding issues to improve your credit standing.

Diversify Your Credit Mix

Having a healthy mix of credit accounts, such as credit cards, loans, and a mortgage, can positively impact your credit score. Lenders like to see that you can manage different types of credit responsibly. Consider diversifying your credit mix over time to show lenders that you are a reliable borrower.