How to get a mortgage loan sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Whether you’re a first-time homebuyer or looking to refinance, understanding the ins and outs of mortgage loans is crucial in navigating the world of real estate financing. Let’s dive into the intricacies of securing a mortgage loan with this ultimate guide.

Understanding Mortgage Loans

When it comes to getting that sweet pad you’ve been dreaming of, you gotta wrap your head around mortgage loans. Let’s break it down for you so you can slide into your new crib like a boss.

Mortgage loans are basically loans you take out to buy a home or property. It’s like borrowing money from a lender to finance your dream home, and then paying it back over time with interest. It’s a big commitment, but it’s how most people afford to own a home.

Types of Mortgage Loans

Alright, here’s the lowdown on the types of mortgage loans you can snag:

- Conventional Loans: These babies are not backed by the government and usually require a solid credit score and a hefty down payment.

- FHA Loans: These are insured by the Federal Housing Administration and are great for first-time homebuyers who might not have a huge down payment saved up.

- VA Loans: These are for veterans and active-duty service members, offering some sweet benefits like no down payment and lower interest rates.

- USDA Loans: Perfect for those looking to buy in rural areas, these bad boys are backed by the U.S. Department of Agriculture.

Importance of Credit Score

Your credit score is like your golden ticket when it comes to applying for a mortgage loan. Lenders use it to determine how risky you are as a borrower. The higher your credit score, the better your chances of getting approved for a loan with a killer interest rate.

Difference Between Fixed-Rate and Adjustable-Rate Mortgages

Let’s talk about the two main types of mortgages:

Fixed-Rate Mortgages: These bad boys have a set interest rate that doesn’t change over the life of the loan. It’s like having a consistent monthly payment that won’t give you any surprises.

Adjustable-Rate Mortgages: With these, the interest rate can change after an initial period. Your monthly payment could go up or down depending on market conditions, so it’s a bit of a gamble.

Qualifying for a Mortgage Loan

When applying for a mortgage loan, there are several key factors that lenders take into consideration to determine your eligibility. These factors play a crucial role in whether or not you will be approved for a loan and the terms you may receive.

Income and Employment History

Income and employment history are significant factors that lenders look at when assessing your mortgage loan application. Lenders want to ensure that you have a stable source of income to make timely mortgage payments. They will evaluate your employment history to see if you have a consistent work record.

- Make sure you have a steady income from a reliable source.

- Provide documentation of your employment history, including pay stubs and tax returns.

- Having a stable job with a regular income can increase your chances of loan approval.

Improving Credit Score

Your credit score plays a crucial role in determining your eligibility for a mortgage loan. Lenders use your credit score to assess your creditworthiness and determine the interest rate you may receive. A higher credit score can increase your chances of loan approval and help you secure better loan terms.

- Pay your bills on time to improve your credit score.

- Reduce your outstanding debt and keep credit card balances low.

- Regularly check your credit report for errors and dispute any inaccuracies.

Debt-to-Income Ratio

The debt-to-income ratio is another important factor that lenders consider when evaluating your mortgage loan application. This ratio compares your monthly debt payments to your gross monthly income. Lenders use this ratio to assess your ability to manage additional debt and make mortgage payments on time.

Having a lower debt-to-income ratio can increase your chances of loan approval as it demonstrates your ability to manage your financial obligations.

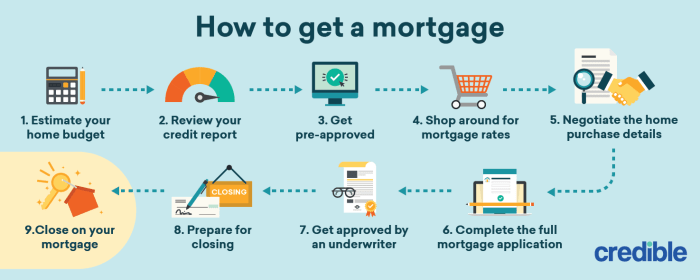

Mortgage Loan Application Process

When it comes to applying for a mortgage loan, there are several key steps involved in the process. From gathering documentation to pre-approval, each stage plays a crucial role in securing your loan for the house of your dreams.

Documentation Required for a Mortgage Loan Application

- Gather your proof of income, such as pay stubs or tax returns.

- Provide documentation of your assets, including bank statements and investment accounts.

- Submit information on your debts, like credit card statements and loan balances.

- Have proof of identification ready, such as a driver’s license or passport.

Tips to Speed Up the Mortgage Loan Approval Process

- Organize all your financial documents beforehand to streamline the application process.

- Respond promptly to any requests from your lender to avoid delays.

- Ensure your credit report is accurate and up to date before applying for a mortgage.

- Consider getting pre-approved for a mortgage to show sellers you are a serious buyer.

Importance of Pre-Approval Before House Hunting

Getting pre-approved for a mortgage is essential before starting your house hunting journey. It gives you a clear idea of how much you can afford to spend on a home, making your search more efficient and focused. Additionally, sellers are more likely to take your offer seriously if you have pre-approval, as it demonstrates your financial readiness.

Choosing the Right Mortgage Loan

When it comes to choosing the right mortgage loan, you need to consider various factors to ensure you make the best decision for your financial situation.

Comparing Mortgage Loan Options

- Compare different mortgage loan options based on interest rates and terms to find the most suitable one for your needs.

- Consider fixed-rate mortgages for stable payments or adjustable-rate mortgages for potential savings in the short term.

Government-Backed Loans vs. Conventional Loans

- Government-backed loans like FHA loans offer lower down payment requirements but may come with higher mortgage insurance costs.

- Conventional loans usually require a higher down payment but may have more flexibility in terms and lower overall costs.

Choosing the Right Mortgage Lender

- Research and compare different mortgage lenders to find one that offers competitive rates and excellent customer service.

- Read reviews and ask for recommendations from friends or family members who have recently obtained a mortgage.

Significance of Down Payment

- A higher down payment can result in lower monthly payments and reduced interest costs over the life of the loan.

- Consider your financial situation and long-term goals when deciding on the amount of down payment to make.