Dive into the world of Financial Literacy for Kids with this cool and informative guide. Get ready to explore the ins and outs of teaching kids about money in a way that’s engaging and empowering.

From defining financial literacy to highlighting key concepts, this journey will equip you with the knowledge to help kids make smart financial decisions early on.

Introduction to Financial Literacy for Kids

In today’s world, it’s crucial to equip kids with the knowledge and skills to make smart financial decisions from a young age. Financial literacy for kids refers to the ability to understand and manage money wisely.

It is important to teach kids about financial literacy to set them up for a successful future and help them avoid common financial pitfalls. By instilling good financial habits early on, kids can develop a strong foundation for financial independence and security.

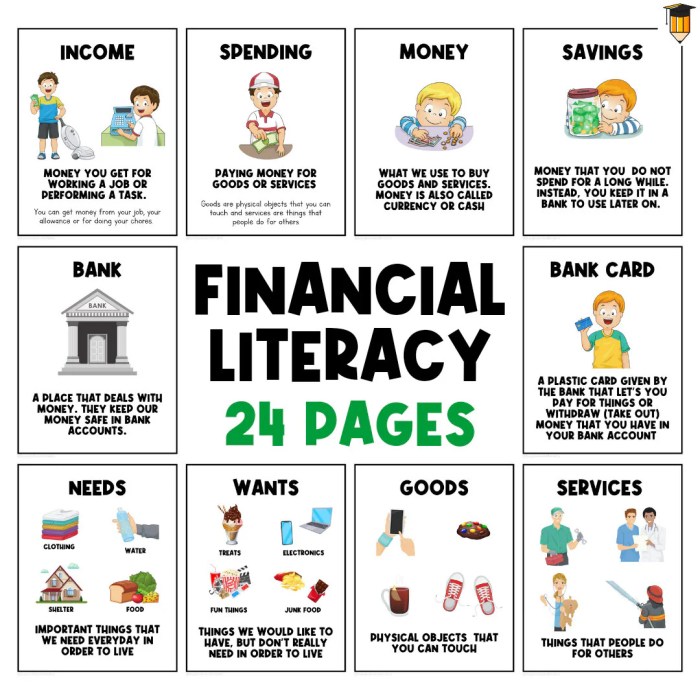

Examples of Basic Financial Concepts Suitable for Kids

- Allowance Management: Teaching kids how to budget and save their allowance money for short-term and long-term goals.

- Needs vs. Wants: Differentiating between essential expenses (needs) and non-essential purchases (wants).

- Setting Savings Goals: Encouraging kids to set specific savings goals, such as saving for a toy or a trip.

- Understanding the Value of Money: Explaining the concept of earning money through work and the importance of making thoughtful spending decisions.

- Charitable Giving: Introducing the idea of giving back by donating a portion of their money to a cause they care about.

Benefits of Teaching Financial Literacy to Kids

Teaching kids about financial literacy at an early age can have a profound impact on their long-term financial well-being. By instilling good money habits and knowledge early on, children are better equipped to make informed financial decisions as they grow older.

Empowering Kids to Make Better Financial Decisions

Teaching financial literacy to kids can help them develop critical thinking skills when it comes to managing money. By understanding concepts like budgeting, saving, and investing, children are more likely to make wise financial choices in the future. For example, a child who learns about the importance of saving money may be less likely to overspend or go into debt as an adult.

Encouraging Financial Responsibility

Financial literacy empowers kids to take control of their finances and become responsible stewards of their money. By teaching kids about the consequences of financial decisions and how to set financial goals, they are more likely to develop good money habits that will benefit them throughout their lives. For instance, a child who learns about the power of compounding interest may be motivated to start saving and investing early to secure their financial future.

Strategies for Teaching Financial Literacy to Kids

Teaching financial literacy to kids is crucial for their future success. Here are some effective strategies to help kids understand the importance of managing money wisely.

Age-Appropriate Methods for Teaching Financial Literacy

When teaching financial literacy to different age groups of kids, it’s essential to tailor the lessons to their level of understanding. For younger children, use simple concepts like saving money in a piggy bank or playing money-related games. For older kids, introduce topics like budgeting, investing, and understanding the value of money through real-life examples.

Role of Parents, Schools, and Caregivers

Parents play a vital role in teaching financial literacy to kids by setting a good example, involving kids in money-related discussions, and encouraging saving habits. Schools can incorporate financial literacy into their curriculum and organize workshops or seminars on money management. Other caregivers, such as relatives or mentors, can also provide valuable insights and guidance on financial matters.

Creative Activities and Games

Making learning about finances fun for kids can be achieved through creative activities and games. Board games like Monopoly or The Game of Life can teach kids about budgeting, investing, and making financial decisions. Setting up a pretend store or hosting a lemonade stand can also help kids learn about earning money and managing expenses in a practical way.

Key Financial Concepts to Teach Kids

Teaching kids essential financial concepts at a young age is crucial for their future financial well-being. By instilling these concepts early on, children can develop good money habits that will benefit them throughout their lives.

Saving

- Explain to kids the importance of saving money for future goals and emergencies.

- Encourage them to set savings goals and track their progress.

- Teach them the concept of compound interest and how their money can grow over time.

Budgeting

- Show kids how to create a budget by allocating money for different purposes such as saving, spending, and giving.

- Help them understand the difference between needs (essential items) and wants (non-essential items).

- Teach them to prioritize their spending based on their budget and goals.

Earning, Spending, and Giving

- Teach kids about earning money through chores, allowances, or other age-appropriate activities.

- Discuss responsible spending habits, such as comparing prices, avoiding impulse purchases, and staying within budget.

- Encourage kids to give back by donating to charity, volunteering, or helping others in need.