Diving into the world of finance and mental health, this intro sets the stage for a dynamic exploration that’s bound to captivate and enlighten. Get ready to uncover the intricate relationship between your wallet and well-being.

In the following paragraphs, we will delve deeper into the impact of financial stress on mental health and ways to navigate this complex intersection.

The Intersection of Finance and Mental Health

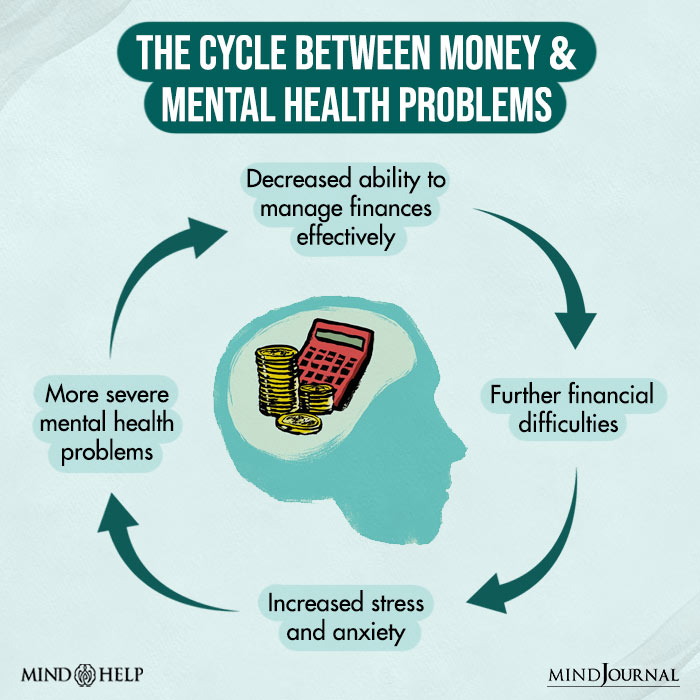

Financial stress can have a significant impact on mental health, leading to increased levels of anxiety, depression, and overall emotional distress. The constant worry about money, debt, or financial instability can take a toll on one’s mental well-being and quality of life.

Correlation between Financial Stability and Overall Well-being

- Financial stability is closely linked to overall well-being, as it provides a sense of security and peace of mind. When individuals feel financially secure, they are less likely to experience high levels of stress and anxiety.

- Having control over one’s finances and being able to meet financial goals can boost self-esteem and confidence, contributing to a positive mental outlook.

- Conversely, financial instability, such as debt, unemployment, or unexpected expenses, can lead to feelings of helplessness, hopelessness, and increased risk of mental health issues.

Importance of Addressing Mental Health when Managing Finances

- Addressing mental health is crucial when managing finances, as mental well-being directly impacts financial decision-making abilities and behaviors.

- Individuals struggling with mental health issues may find it challenging to make sound financial choices, leading to impulsive spending, neglecting bills, or avoiding financial responsibilities altogether.

- Seeking support for mental health concerns, such as therapy, counseling, or medication, can help individuals better manage their finances by improving cognitive function, reducing stress levels, and enhancing overall well-being.

Financial Strategies for Mental Health

When it comes to managing your finances, it’s important to consider the impact it can have on your mental health. By implementing effective financial strategies, you can reduce stress and anxiety, leading to better overall well-being.

Budgeting Techniques to Reduce Financial Anxiety

- Track your expenses: Keep a record of all your spending to identify areas where you can cut back.

- Create a budget: Allocate specific amounts to different expense categories to ensure you’re not overspending.

- Build an emergency fund: Set aside money for unexpected expenses to avoid financial stress in times of crisis.

- Avoid unnecessary debt: Limit the use of credit cards and loans to prevent accumulating high-interest debt.

Tips on How to Prioritize Mental Health in Financial Decisions

- Set financial goals: Establish clear objectives that align with your values and mental well-being.

- Practice self-care: Invest in activities that promote relaxation and reduce stress, even if they come with a cost.

- Seek support: Talk to a financial advisor or therapist to get guidance on managing both your finances and mental health.

Benefits of Seeking Professional Help for Financial and Mental Health Issues

- Expert guidance: Professionals can offer personalized advice based on your unique circumstances and goals.

- Increased accountability: Working with a professional can help you stay on track with your financial and mental health objectives.

- Improved outcomes: Seeking help early can lead to better financial decisions and enhanced mental well-being in the long run.

Psychological Factors Influencing Financial Behavior

Emotions play a significant role in shaping our financial decisions. Fear and stress can greatly impact how we manage our money and investments, often leading to impulsive or irrational choices that can have long-term consequences on our financial health.

Emotional Spending and its Impact on Financial Health

Emotional spending refers to the act of making purchases based on emotions rather than necessity or financial goals. This behavior can lead to overspending, debt accumulation, and financial instability. It is essential to recognize triggers for emotional spending, such as stress, boredom, or social pressure, and develop strategies to avoid impulsive purchases.

- Set a budget and stick to it: Creating a budget can help you track your expenses and prioritize your spending based on your financial goals.

- Avoid impulse purchases: Take a moment to pause and evaluate whether a purchase is necessary or if it is driven by emotions.

- Practice mindful spending: Be aware of your emotions and thoughts when making financial decisions, and consider the long-term impact of your choices.

- Seek support: If emotional spending becomes a recurring issue, consider seeking help from a financial advisor or therapist to develop healthier coping mechanisms.

Developing a Healthy Mindset towards Money Management

Having a positive and proactive mindset towards money management is crucial for financial well-being. By cultivating healthy financial habits and attitudes, you can reduce stress, improve decision-making, and work towards long-term financial stability.

“Money is a tool. It will take you wherever you wish, but it will not replace you as the driver.” – Ayn Rand

- Set financial goals: Define your short-term and long-term financial goals to provide a clear direction for your money management strategies.

- Practice financial mindfulness: Regularly review your financial situation, track your expenses, and make intentional decisions to align your spending with your goals.

- Build an emergency fund: Having savings set aside for unexpected expenses can help reduce financial stress and provide a safety net during challenging times.

- Invest in financial education: Continuously educate yourself on personal finance topics to make informed decisions and improve your financial literacy.

Resources for Managing Finance and Mental Health

In today’s fast-paced world, managing both finances and mental health can be challenging. Thankfully, there are various resources available to help individuals navigate these important aspects of their lives.

Apps and Tools for Tracking Finances and Mental Well-being

- Mint: This popular app allows users to track their expenses, create budgets, and set financial goals. It also provides insights into spending habits that can impact mental well-being.

- Headspace: Known for its meditation and mindfulness exercises, Headspace can help reduce stress and anxiety related to financial worries.

- You Need A Budget (YNAB): YNAB helps users prioritize their spending, reduce financial stress, and improve overall financial well-being, which can positively impact mental health.

Support Groups and Organizations

- National Alliance on Mental Illness (NAMI): NAMI offers support, education, and advocacy for individuals living with mental health conditions, including resources for managing financial stress.

- Financial Therapy Association: This organization focuses on the emotional, psychological, and behavioral aspects of money and finances, providing valuable insights for individuals dealing with financial and mental health challenges.

Role of Therapy or Counseling

Therapy or counseling can play a crucial role in addressing the intersection of finance and mental health. Professionals in this field can help individuals explore the emotional impact of financial decisions, develop healthy coping mechanisms, and create strategies for managing both financial and mental well-being effectively.