Diving into the realm of ethical investing opens up a world of financial decisions intertwined with moral considerations, creating a dynamic landscape where profits and principles intersect. As we delve deeper, we uncover the strategies, impacts, and challenges that shape the ethical investing sphere.

From aligning personal values with investment goals to navigating the complexities of ethical criteria, ethical investing offers a unique approach to financial planning that goes beyond traditional profit-seeking motives.

Definition of Ethical Investing

Ethical investing, also known as socially responsible investing (SRI), is an approach to investing that considers both financial return and ethical/moral values. This type of investing involves selecting companies or funds that align with the investor’s personal values and beliefs. The significance of ethical investing lies in promoting positive social and environmental change through the allocation of capital.

Examples of Ethical Investment Strategies

- Impact Investing: Investing in companies or funds that aim to generate measurable social or environmental impact alongside financial returns.

- Divestment: Avoiding investments in companies involved in industries like tobacco, weapons, or fossil fuels due to ethical concerns.

- Shareholder Advocacy: Engaging with companies as a shareholder to advocate for positive changes in policies and practices.

Impact of Ethical Investing on Society and the Environment

Ethical investing plays a crucial role in driving positive change in society and the environment. By directing capital towards companies with strong ethical practices, investors can support initiatives that promote sustainability, diversity, and social responsibility. This can lead to a shift in corporate behavior towards more ethical and sustainable practices, ultimately benefiting both society and the planet.

Types of Ethical Investment Approaches

When it comes to ethical investing, there are different approaches that investors can take to align their investments with their values. Some of the key types of ethical investment approaches include ESG investing, socially responsible investing, and impact investing.

ESG Investing

ESG investing stands for Environmental, Social, and Governance investing. This approach involves considering a company’s performance in these three key areas when making investment decisions. Companies that score well on ESG criteria are typically seen as more sustainable and responsible investments. For example, a company that focuses on reducing its carbon footprint or promoting diversity and inclusion in the workplace would be considered a good candidate for ESG investing.

Socially Responsible Investing

Socially responsible investing focuses on investing in companies that align with the investor’s ethical beliefs and values. This approach often involves screening out companies that are involved in controversial industries such as tobacco, weapons, or gambling. Instead, socially responsible investors seek out companies that have a positive impact on society and the environment. For instance, investing in a company that prioritizes fair labor practices and community engagement would fall under socially responsible investing.

Impact Investing

Impact investing goes beyond simply avoiding harm and actively seeks to make a positive impact through investments. This approach involves investing in companies, organizations, or funds with the intention of generating measurable social or environmental impact alongside a financial return. Impact investors may support companies that are working towards solving global challenges like poverty, climate change, or healthcare access. One example of impact investing is investing in a renewable energy company that is developing innovative solutions to combat climate change.

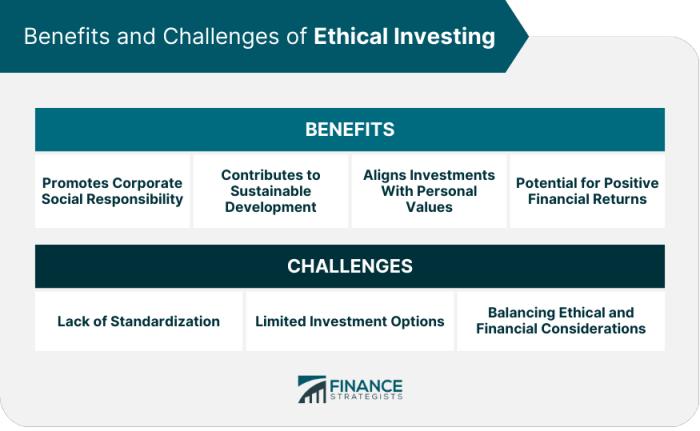

Benefits of Ethical Investing

Investing ethically brings a host of benefits to investors, companies, and society as a whole. By aligning financial goals with values, ethical investing can lead to positive outcomes that extend beyond just financial returns.

Advantages for Investors, Companies, and Society

Ethical investing can lead to long-term sustainable growth by attracting socially conscious investors who are committed to supporting companies that operate responsibly. This can result in increased capital flows to companies with strong environmental, social, and governance (ESG) practices, driving innovation and growth in sustainable industries.

- For Investors: Ethical investing allows investors to align their portfolios with their values, creating a sense of purpose and fulfillment. It can also provide opportunities for diversification and potentially higher returns in the long run.

- For Companies: Embracing ethical practices can enhance a company’s reputation, attract top talent, and foster stronger relationships with customers and stakeholders. This can lead to improved brand loyalty and competitive advantage in the market.

- For Society: Ethical investing promotes positive social and environmental impact, contributing to a more sustainable future for all. By supporting companies that prioritize ethical considerations, investors can drive positive change and address pressing global challenges.

Investing ethically is not just about doing good; it’s also about doing well financially in the long term.

Challenges and Criticisms of Ethical Investing

In the world of ethical investing, there are certain challenges and criticisms that investors may face. These can impact the effectiveness of ethical investing strategies and the decision-making process for investors.

Limited Investment Options

One of the challenges faced by ethical investors is the limited range of investment options available to them. As ethical criteria are applied to investments, this can restrict the pool of companies or industries that meet the ethical standards set by the investor. This limitation may result in a more narrow selection of potential investments, potentially affecting portfolio diversification.

Performance Concerns

Another challenge is the concern over the performance of ethical investments compared to traditional investments. Some investors worry that by excluding certain industries or companies based on ethical criteria, they may miss out on profitable opportunities. This performance concern can lead investors to question the financial returns of ethical investing and whether it can truly be as lucrative as traditional investing.

Common Criticisms of Ethical Investing

Common criticisms of ethical investing include accusations of greenwashing and subjectivity in ethical criteria. Greenwashing refers to companies presenting a false image of environmental responsibility to appeal to ethical investors. This can mislead investors who are trying to make socially responsible investments. Additionally, the subjectivity of ethical criteria means that what is considered ethical can vary from one investor to another, leading to inconsistencies in ethical investment decisions.

Impact on Effectiveness

These challenges and criticisms can impact the effectiveness of ethical investing strategies by creating uncertainty and doubt among investors. Limited investment options and performance concerns may deter some investors from pursuing ethical investing, while criticisms of greenwashing and subjectivity can erode trust in the ethical investing process. It is essential for investors to navigate these challenges carefully and stay informed to make informed decisions in the world of ethical investing.

Incorporating Ethical Investing in Financial Planning

When it comes to financial planning, incorporating ethical investing can be a great way to align your investment goals with your personal values. By choosing to invest in companies that are socially responsible and environmentally conscious, you can make a positive impact while also aiming for financial growth.

Assessing Ethical Performance of Investments

- Research the company: Look into the company’s policies, practices, and track record to determine if they align with your ethical values.

- Consider ESG criteria: Evaluate investments based on environmental, social, and governance factors to ensure they meet sustainable and ethical standards.

- Consult ethical investing platforms: Use online tools and platforms that specialize in ethical investing to help you make informed decisions.

Aligning Investment Goals with Personal Values

- Define your values: Identify the social and environmental causes that are important to you and seek out investments that support those causes.

- Create a diversified portfolio: Build a portfolio that aligns with your values while also spreading risk across different industries and asset classes.

- Stay informed: Keep up to date with news and developments in ethical investing to ensure your portfolio continues to reflect your values.