Hey there, savvy readers! Today, we’re diving into the world of debt reduction strategies with a twist of American high school coolness. Get ready to learn how to tackle your debts like a boss and pave the way to financial freedom.

In this guide, we’ll explore different types of strategies, tips for success, and how to create a personalized plan that fits your unique financial situation. So, grab your favorite snack, kick back, and let’s get started!

Importance of Debt Reduction Strategies

Effective debt reduction strategies are crucial for achieving financial stability. By implementing these strategies, individuals can take control of their finances, reduce their debt burden, and work towards achieving their financial goals.

Examples of Debt Reduction Strategies

- Creating a budget and tracking expenses to identify areas where spending can be reduced

- Consolidating high-interest debts into a lower interest loan or credit card

- Increasing income through side gigs or freelance work to accelerate debt repayment

- Negotiating with creditors for lower interest rates or extended payment terms

Long-Term Benefits of Debt Reduction Strategies

- Improved credit score: By reducing debt, individuals can improve their credit score, making it easier to access loans and credit in the future.

- Reduced financial stress: Eliminating debt can significantly reduce financial stress and improve overall well-being.

- Increased savings: With less debt to repay, individuals can redirect funds towards savings and investments, building wealth for the future.

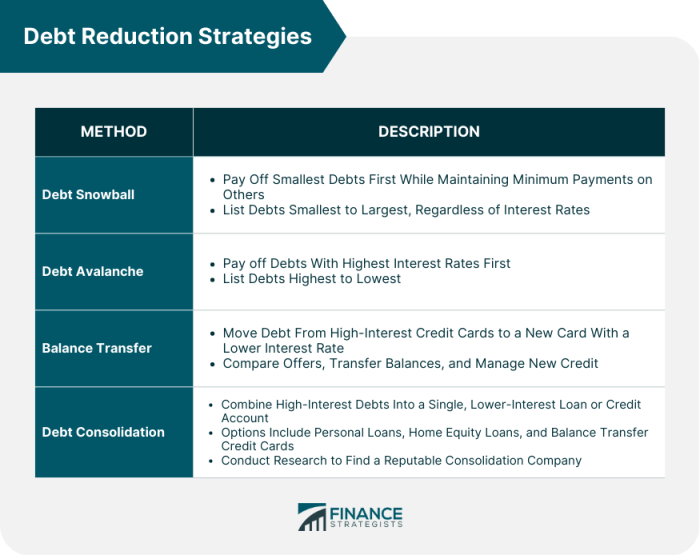

Types of Debt Reduction Strategies

When it comes to tackling debt, there are several strategies that individuals can use to reduce and eventually eliminate their financial obligations. Each strategy has its own approach and benefits, so it’s essential to understand how they work to choose the one that best fits your financial situation.

Snowball Method

The snowball method involves paying off your debts from smallest to largest, regardless of interest rates. By focusing on the smallest debt first, you gain momentum and motivation as you see debts being paid off one by one. While this method can be effective for building confidence, it may not save you as much money on interest compared to other strategies.

Avalanche Method

On the other hand, the avalanche method prioritizes debts with the highest interest rates first, allowing you to save more money on interest payments in the long run. While this approach may not provide the immediate satisfaction of the snowball method, it can lead to significant savings over time.

Debt Consolidation

Debt consolidation involves combining multiple debts into a single loan with a lower interest rate. This can simplify your payments and potentially reduce the overall amount of interest you pay. However, it’s crucial to be cautious with debt consolidation, as it may extend the repayment period and lead to more total interest paid if not managed properly.

Real-life Examples

For instance, Sarah used the snowball method to pay off her credit card debt by starting with the smallest balance and gradually working her way up. On the other hand, John opted for the avalanche method to tackle his student loans, prioritizing the ones with the highest interest rates to save money in the long term. Lastly, Emily chose debt consolidation to combine her multiple high-interest loans into a single monthly payment with a lower rate, making it easier to manage her finances.

Creating a Personalized Debt Reduction Plan

When it comes to tackling your debt, having a personalized plan in place can make all the difference in achieving financial freedom. By following the steps below, setting realistic goals, and prioritizing your debts, you can create a plan that works for your individual financial situation.

Steps in Creating a Personalized Debt Reduction Plan

- Assess Your Debts: Start by listing out all of your debts, including the amount owed, interest rates, and minimum monthly payments.

- Evaluate Your Budget: Take a close look at your income and expenses to determine how much you can realistically allocate towards paying off your debts each month.

- Set Realistic Goals: Determine how much you want to pay off each month and set a timeline for when you want to be debt-free. Make sure these goals are achievable based on your financial situation.

- Choose a Strategy: Decide on a debt reduction strategy that aligns with your goals and financial capabilities. This could be the snowball method, avalanche method, or debt consolidation.

- Monitor Your Progress: Regularly track your payments and progress towards your goals. Adjust your plan as needed to stay on track.

Importance of Setting Realistic Goals and Timelines

Setting realistic goals and timelines is crucial when developing a debt reduction plan. It helps keep you motivated, provides a clear roadmap for success, and ensures that you are making steady progress towards becoming debt-free. By setting achievable goals and timelines, you can avoid feeling overwhelmed and stay focused on your financial objectives.

Tips on Prioritizing Debts and Choosing a Strategy

- Focus on High-Interest Debts: Start by tackling debts with the highest interest rates first to minimize the amount of interest you pay over time.

- Consider Your Financial Situation: Choose a debt reduction strategy that works best for you based on factors such as income, expenses, and overall debt amount.

- Seek Professional Advice: If you’re unsure about which strategy to use, consider consulting a financial advisor or credit counselor for personalized guidance.

- Stay Committed: Consistency is key when it comes to debt reduction. Stick to your plan, make timely payments, and avoid taking on new debt to ensure long-term success.

Tips for Successful Debt Reduction

When it comes to reducing debt, it’s essential to have a solid plan in place and stick to it. Here are some practical tips to help you stay on track and reach your financial goals.

Role of Budgeting in Debt Reduction

Budgeting plays a crucial role in successful debt reduction. By creating a detailed budget, you can track your expenses, identify areas where you can cut back, and allocate more funds towards paying off your debts. Make sure to prioritize your debt payments in your budget to ensure you’re making progress towards becoming debt-free.

Tracking Expenses for Better Financial Management

Tracking your expenses is another key component of successful debt reduction. By keeping a close eye on where your money is going, you can identify unnecessary spending habits and make adjustments to free up more funds for debt repayment. Consider using apps or spreadsheets to help you track your expenses effectively.

Increasing Income to Accelerate Debt Payoff

Increasing your income can also significantly impact your debt reduction journey. Look for ways to earn extra money, such as taking on a side hustle, freelancing, or selling unused items. By boosting your income, you can make larger debt payments and pay off your debts faster.

Staying Motivated Throughout the Process

Staying motivated is crucial when it comes to successfully reducing debt. Set small, achievable goals along the way to celebrate your progress and keep yourself motivated. Surround yourself with a supportive community or accountability partner to help you stay on track during challenging times. Remember, every step you take towards reducing your debt brings you closer to financial freedom.