How to create a budget sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Understanding the importance of budgeting and financial planning is crucial for anyone looking to take control of their finances. In this guide, we will explore the key components of creating a budget and how it can help you achieve your financial goals.

Understanding Budgeting

Budgeting is like making a financial plan for your money. It helps you track your income, expenses, and savings to ensure you are in control of your finances. Creating a budget is essential for managing your money effectively and achieving your financial goals.

Importance of Budgeting

- Allows you to see where your money is going and identify areas where you can save.

- Helps you avoid overspending and going into debt.

- Enables you to plan for future expenses and emergencies.

- Gives you a clear picture of your financial health and progress towards your goals.

Components of a Budget

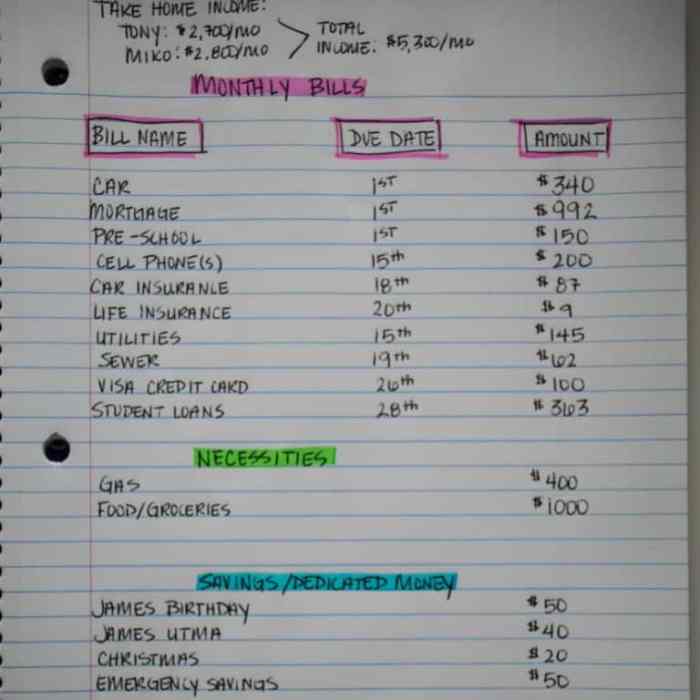

- Income: This includes all the money you earn, such as salary, bonuses, or any other sources of income.

- Expenses: These are all the costs you have to pay, like rent, utilities, groceries, and entertainment.

- Savings: Setting aside a portion of your income for future goals or emergencies.

- Debt Payments: Any money you allocate towards paying off debts like student loans, credit card debt, or a mortgage.

Setting Financial Goals

Setting financial goals is a crucial step in creating a budget as it gives you a clear target to work towards. Whether it’s saving for a big purchase, paying off debt, or building an emergency fund, having specific financial goals helps you stay motivated and focused on your financial journey.

Short-term and Long-term Financial Goals

- Short-term financial goals: These are goals that you aim to achieve within the next few months to a year. Examples include saving for a vacation, paying off credit card debt, or building an emergency fund.

- Long-term financial goals: These are goals that you plan to achieve over several years. Examples include buying a home, saving for retirement, or funding your child’s education.

Financial goals play a significant role in shaping your budget decisions. They help prioritize where you allocate your money, whether it’s towards savings, investments, or paying off debt. By setting financial goals, you can create a budget that aligns with your priorities and values, making it easier to track your progress and make adjustments as needed.

Tracking Income and Expenses

When it comes to budgeting, tracking your income and expenses is key to staying on top of your financial game. By accurately monitoring your cash flow, you can make informed decisions and take control of your financial future.

Tracking Income Sources

- Make a list of all your income sources, including paychecks, side hustles, investments, and any other money coming in regularly.

- Use a budgeting app or spreadsheet to record each income source and the amount received, categorizing them for easy reference.

- Regularly update your income records to ensure you have an accurate picture of how much money you have coming in.

Methods for Categorizing and Tracking Expenses

- Organize your expenses into categories such as housing, groceries, utilities, transportation, entertainment, and savings.

- Keep all your receipts and bills organized to track every dollar you spend within each category.

- Consider using budgeting apps that automatically categorize your expenses for you, saving you time and effort.

Importance of Monitoring Spending Habits

- Tracking your expenses helps you identify where your money is going and pinpoint areas where you can cut back or make adjustments.

- By monitoring your spending habits, you can avoid overspending, prioritize your financial goals, and make smarter financial decisions.

- Regularly reviewing your income and expenses allows you to stay accountable and make necessary changes to improve your financial health.

Creating a Budget Plan

Creating a budget plan is essential for managing your finances effectively. It helps you track your income, expenses, and savings goals. Here are the steps to create a basic budget plan:

Different Budgeting Methods

- Zero-Based Budgeting: In this method, every dollar of income is assigned a specific purpose, whether it’s expenses, savings, or investments. This helps ensure that every dollar is accounted for.

- 50/30/20 Rule: With this method, 50% of your income goes towards needs (such as rent and groceries), 30% towards wants (like entertainment and dining out), and 20% towards savings and debt repayment.

Adjusting a Budget Plan

- Regularly Review: Take the time to review your budget plan regularly, preferably monthly, to see if you are on track with your financial goals.

- Be Flexible: Life is unpredictable, so it’s important to be flexible with your budget. If unexpected expenses come up, adjust your budget accordingly.

- Track Your Progress: Keep track of your spending and savings to see how well you are sticking to your budget plan. This will help you make necessary adjustments.

Saving and Emergency Funds

Saving money and building an emergency fund are crucial components of a well-rounded budget. By including savings in your budget, you are preparing for future expenses, investments, and unexpected financial setbacks. It helps you achieve financial stability and peace of mind.

Importance of Including Savings in a Budget

- Having savings allows you to cover unexpected expenses without going into debt.

- Saving money for the future, such as retirement or major purchases, ensures financial security.

- It helps you reach your financial goals faster, whether it’s buying a house, starting a business, or going on a dream vacation.

Strategies for Building an Emergency Fund

- Set a specific savings goal for your emergency fund, such as three to six months’ worth of living expenses.

- Automate your savings by setting up automatic transfers from your checking account to a separate savings account.

- Cut back on unnecessary expenses and redirect that money into your emergency fund.

- Consider earning extra income through side hustles or freelance work to boost your savings.

Tips on Automating Savings Contributions

- Use direct deposit to automatically allocate a portion of your paycheck into your savings account.

- Set up recurring transfers from your checking to savings account on a regular basis, such as weekly or monthly.

- Take advantage of apps or online tools that round up your purchases to the nearest dollar and deposit the spare change into your savings.

Budgeting Tools and Apps

Budgeting tools and apps are essential for managing your finances effectively in this digital age. They can help you track your spending, set savings goals, and stay on top of your budget effortlessly. Let’s explore some popular options and how they can simplify the budgeting process.

Popular Budgeting Tools and Apps

- Mint: A comprehensive budgeting app that allows you to track your expenses, create budgets, and receive alerts for upcoming bills. It also provides a credit score monitoring feature.

- You Need a Budget (YNAB): YNAB focuses on giving every dollar a job, helping you prioritize your spending and save more effectively. It offers educational resources and live workshops.

- Personal Capital: Ideal for tracking investments and retirement accounts, Personal Capital offers a holistic view of your financial health. It also includes tools for retirement planning.

- PocketGuard: This app categorizes your expenses, tracks your bills, and helps you find ways to save money. It gives you a snapshot of your financial situation at a glance.

Comparison of Features

| Tool/App | Key Features |

|---|---|

| Mint | Expense tracking, budget creation, bill alerts, credit score monitoring |

| YNAB | Every dollar a job, savings prioritization, educational resources |

| Personal Capital | Investment tracking, retirement account overview, retirement planning tools |

| PocketGuard | Expense categorization, bill tracking, savings optimization |

Simplifying Budgeting with Technology

Using budgeting tools and apps can streamline the process of managing your finances. These digital solutions offer automation, real-time updates, and intuitive interfaces that make it easier to stay organized and make informed financial decisions. By leveraging technology, you can take control of your budget with ease and precision.