Yo, listen up! Investing in index funds is where it’s at. Get ready to dive into the world of smart money moves, as we break down the ins and outs of this game-changing investment strategy.

Let’s get started on this financial journey like a boss.

What are index funds?

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks a specific market index, such as the S&P 500. The main goal of an index fund is to replicate the performance of the index it is tracking.

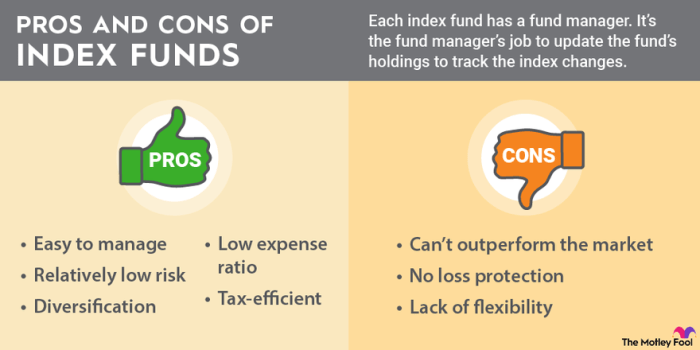

Index funds are passively managed, meaning they aim to mirror the performance of the index rather than trying to outperform it through active trading. This sets them apart from actively managed funds, where fund managers make investment decisions in an attempt to beat the market.

Comparison to actively managed funds

When comparing index funds to actively managed funds, one key difference is the fees involved. Index funds typically have lower expense ratios since they require less active management. This can result in higher returns for investors over the long term due to lower costs.

Additionally, index funds offer broad market exposure, as they track entire market indexes. This diversification helps reduce risk by spreading investments across multiple companies and industries. Actively managed funds, on the other hand, may have more concentrated holdings based on the fund manager’s strategy.

Benefits of investing in index funds

- Low Costs: Index funds generally have lower fees compared to actively managed funds, which can eat into overall returns.

- Diversification: By tracking an entire market index, investors benefit from diversification across a wide range of securities.

- Consistent Performance: Index funds aim to match the performance of the index, providing a predictable investment return over time.

- Passive Management: The hands-off approach of index funds means less frequent trading, potentially reducing capital gains taxes for investors.

How to invest in index funds?

Investing in index funds can be a great way to build wealth over time. Here are the steps to get started:

Choose a Platform or Brokerage

When investing in index funds, you can choose from a variety of platforms or brokerages. Some popular options include Vanguard, Fidelity, and Charles Schwab. It’s important to research each platform to find one that aligns with your investment goals and offers low fees.

Minimum Investment Requirements

Most index funds have minimum investment requirements, which can vary depending on the fund and the platform you choose. Some funds may require a minimum investment of $1,000 or more, while others may have no minimum investment at all. It’s important to check the specific requirements of the fund you’re interested in before investing.

Types of index funds to consider

When considering investing in index funds, it’s essential to understand the different types available in the market. Each type of index fund has its unique characteristics and risk factors that investors should consider before making investment decisions.

Broad Market Index Funds

Broad market index funds track the performance of a wide range of securities across various industries and sectors. These funds are designed to provide investors with diversified exposure to the overall stock market. Examples of broad market index funds include the S&P 500 Index Fund and the Total Stock Market Index Fund.

- Broad market index funds offer broad diversification, reducing the risk associated with investing in individual stocks.

- They are ideal for long-term investors seeking steady growth over time.

- However, broad market index funds may not outperform the market during bullish phases, as they aim to replicate the market performance rather than beat it.

Sector-Specific Index Funds

Sector-specific index funds focus on a specific industry or sector of the economy, such as technology, healthcare, or energy. These funds allow investors to target their investments in a particular sector they believe will outperform the broader market.

- Sector-specific index funds can provide higher returns if the chosen sector performs well.

- Investors can take advantage of growth opportunities in specific industries with sector-specific funds.

- However, sector-specific index funds are more volatile and carry higher risk compared to broad market index funds due to their concentrated exposure.

It’s important for investors to consider their risk tolerance and investment goals when choosing between broad market and sector-specific index funds.

Factors to consider before investing in index funds

When considering investing in index funds, there are several key factors to keep in mind to make an informed decision. Factors such as expense ratios, diversification, historical performance, and asset allocation play a crucial role in determining the success of your investment.

Expense Ratios

Expense ratios are the fees charged by the fund manager for managing the index fund. It is essential to consider low expense ratios as they can significantly impact your overall returns. Look for index funds with lower expense ratios to maximize your profits in the long run.

Diversification

Diversification is the practice of spreading your investments across different asset classes to reduce risk. When investing in index funds, diversification is key to mitigating potential losses. Choose index funds that provide exposure to a wide range of sectors and industries to ensure a well-rounded portfolio.

Historical Performance

Analyzing the historical performance of an index fund can give you valuable insights into its potential future returns. Look for index funds that have consistently outperformed their benchmark index over time. However, keep in mind that past performance is not a guarantee of future results.

Asset Allocation

Asset allocation refers to the distribution of your investments across different asset classes such as stocks, bonds, and cash equivalents. It is crucial to determine the right asset allocation based on your risk tolerance and investment goals when investing in index funds. Make sure to rebalance your portfolio periodically to maintain the desired asset allocation.

Rebalancing and monitoring index fund investments

When investing in index funds, it is crucial to regularly rebalance your portfolio to maintain your desired asset allocation and monitor the performance of your investments. Here is how you can effectively manage your index fund investments:

Rebalancing Your Portfolio

Rebalancing your portfolio involves adjusting the allocation of assets in your index funds to align with your investment goals. This process ensures that you maintain the desired level of risk and return in your portfolio. Here are some tips on how to rebalance your index fund investments:

- Review your portfolio periodically to assess if your asset allocation is still in line with your investment objectives.

- Sell assets that have exceeded their target allocation and reinvest the proceeds in underrepresented assets.

- Consider rebalancing on a yearly or bi-yearly basis to prevent your portfolio from drifting too far from your target allocation.

Monitoring Performance of Index Funds

Monitoring the performance of your index funds is essential to evaluate the success of your investment strategy and make informed decisions. Here are some tips on how to monitor the performance of your index funds:

- Track the performance of your index funds against their benchmark index to assess how well they are performing.

- Regularly review the expenses and fees associated with your index funds to ensure they are not eating into your returns.

- Stay informed about market trends and economic developments that may impact the performance of your index funds.

Frequency of Rebalancing

It is recommended to rebalance your index fund investments at least once a year to maintain your target asset allocation. However, you may choose to rebalance more frequently if there are significant market fluctuations or changes in your financial goals. Remember that rebalancing too often can result in unnecessary transaction costs, so find a balance that works best for your investment strategy.