Yo, ready to dive into the world of financial goal setting? Get ready for a ride filled with insights and tips to help you secure that bag and build a solid financial future.

Let’s break down the importance of setting financial goals, the different types you can aim for, strategies to make it happen, and tools to keep you on track. Let’s get this bread!

Importance of Financial Goal Setting

Setting financial goals is crucial for personal financial planning as it provides a roadmap for individuals to follow in order to achieve their desired financial outcomes. By establishing clear objectives, individuals are better able to make informed decisions about their spending, saving, and investing habits.

Achieving Long-Term Financial Stability

Financial goal setting plays a key role in achieving long-term financial stability by helping individuals prioritize their financial needs and allocate resources accordingly. Whether it’s saving for retirement, purchasing a home, or building an emergency fund, having specific financial goals in place can motivate individuals to stay disciplined and focused on their financial objectives.

- Save a specific amount of money each month for retirement

- Pay off high-interest debt within a certain timeframe

- Build an emergency fund that covers 3-6 months of living expenses

Types of Financial Goals

Setting financial goals is crucial in achieving financial success. These goals provide a roadmap for individuals to manage their finances effectively and work towards a secure financial future.

Short-term Financial Goals

Short-term financial goals are typically achievable within a year or less. These goals focus on immediate needs and can help build a solid foundation for long-term financial success. Examples of short-term financial goals include:

- Building an emergency fund

- Pay off credit card debt

- Save for a vacation

Medium-term Financial Goals

Medium-term financial goals are usually achievable within 1 to 5 years. These goals help individuals work towards larger financial objectives while maintaining motivation and momentum. Examples of medium-term financial goals include:

- Buying a car

- Saving for a down payment on a house

- Starting a business

Long-term Financial Goals

Long-term financial goals typically take more than 5 years to achieve and focus on securing financial stability and retirement planning. These goals require consistent saving and investing over an extended period. Examples of long-term financial goals include:

- Retiring comfortably

- Paying off a mortgage

- Planning for children’s education

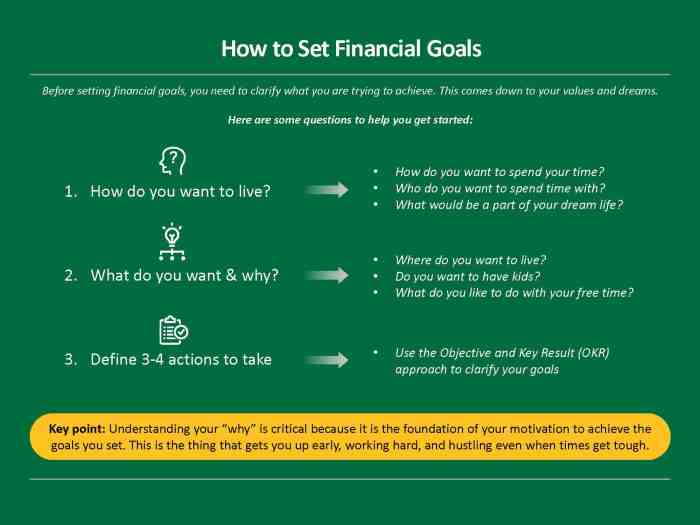

Strategies for Setting Financial Goals

Setting financial goals is crucial for achieving financial success. By following specific strategies, individuals can effectively plan for their future and work towards their desired outcomes.

SMART Criteria for Setting Effective Financial Goals

- Specific: Goals should be clear and well-defined, such as saving a specific amount for a down payment on a house.

- Measurable: Goals should be quantifiable so progress can be tracked, like saving a certain percentage of income each month.

- Achievable: Goals should be realistic based on current financial circumstances and within reach with effort and commitment.

- Relevant: Goals should align with personal values and larger financial objectives, ensuring they are meaningful and motivating.

- Time-bound: Goals should have a deadline or timeframe for completion, providing a sense of urgency and focus.

Importance of Prioritizing Goals in Financial Planning

Prioritizing financial goals helps individuals allocate resources effectively and focus on what matters most. By identifying the most critical goals, such as paying off high-interest debt or building an emergency fund, individuals can make informed decisions about where to allocate their money and efforts.

Revisiting and Adjusting Financial Goals Over Time

It is essential to regularly review and adjust financial goals as circumstances change. Life events, economic conditions, and personal priorities may shift, requiring updates to existing goals or the creation of new ones. By staying flexible and adaptable, individuals can ensure their financial goals remain relevant and achievable in the long run.

Tools and Resources for Financial Goal Setting

Setting financial goals is essential for achieving financial success. To help individuals track and manage their goals effectively, there are several digital tools and resources available. These tools can provide valuable insights, automate processes, and offer guidance to ensure that financial goals are met efficiently.

Digital Tools and Apps for Tracking Financial Goals

- Personal finance apps like Mint, YNAB (You Need a Budget), and PocketGuard allow users to set specific financial goals, track their progress, and analyze their spending habits.

- Investment tracking platforms such as Personal Capital and Wealthfront help individuals monitor their investments and retirement savings to align with their long-term financial goals.

- Debt repayment apps like Debt Payoff Planner and Tally can assist in creating a repayment plan to eliminate debt and achieve financial freedom.

Working with a Financial Advisor

- Collaborating with a financial advisor can provide personalized guidance and expertise in setting realistic and achievable financial goals based on an individual’s unique financial situation.

- A financial advisor can offer insights on investment strategies, risk management, and overall financial planning to ensure that goals are aligned with the individual’s financial capabilities and aspirations.

Role of Budgeting and Saving Techniques

- Creating a budget is crucial in aligning with financial goals as it helps individuals prioritize spending, identify areas for saving, and track progress towards goals.

- Implementing saving techniques such as automatic transfers to a savings account, setting up emergency funds, and practicing frugality can accelerate progress towards achieving financial goals.