Get ready to dive into the world of building a diversified investment portfolio. We’ll explore why diversification is crucial, the types of assets to include, strategies for success, and how to navigate the risks and challenges along the way. Let’s embark on this financial journey together!

Importance of Diversification in Investment Portfolio

Diversification is a crucial strategy in an investment portfolio as it helps spread risk across different assets. By investing in a variety of assets, investors can reduce the impact of a single investment’s poor performance on the overall portfolio.

Managing Risk with Diversification

- Diversification helps manage risk by reducing the impact of volatility in a single asset. For example, if one stock in a portfolio performs poorly, the impact can be offset by the positive performance of other stocks.

- Another example is diversifying across different industries or sectors. This can help protect the portfolio from industry-specific risks, such as regulatory changes or economic downturns affecting a particular sector.

- By spreading investments across different asset classes like stocks, bonds, real estate, and commodities, investors can further reduce risk and increase the chances of positive returns.

Benefits of Diversifying Across Different Asset Classes

- Diversifying across different asset classes can provide a hedge against market fluctuations. For example, when stocks are performing poorly, bonds or real estate investments may offer stability and consistent returns.

- Each asset class has its own risk-return profile, so diversifying across them can help balance the overall risk in the portfolio. This can lead to more stable long-term returns.

- Investing in different asset classes can also provide exposure to various market trends and opportunities, ensuring that the portfolio is not overly dependent on the performance of a single asset or market.

Types of Assets to Include in a Diversified Portfolio

Investing in a diversified portfolio involves including various types of assets to spread risk and maximize returns. Each asset class has its own characteristics and benefits, which can complement each other in a well-balanced portfolio.

Stocks

Stocks represent ownership in a company and offer the potential for high returns, but also come with higher volatility. They are a key component of many investment portfolios due to their growth potential and dividend income.

Bonds

Bonds are debt securities issued by governments or corporations, providing a steady income stream through interest payments. They are considered safer than stocks and can act as a hedge against market volatility.

Real Estate

Real estate investments include properties such as residential, commercial, or rental properties. They offer diversification benefits, potential for rental income, and long-term appreciation. Real estate can provide stability to a portfolio and act as a hedge against inflation.

Commodities

Commodities include physical goods like gold, silver, oil, and agricultural products. They can provide diversification benefits, act as a hedge against inflation, and offer protection during economic downturns. Commodities can be a valuable addition to a diversified portfolio.

Alternative Investments

Alternative investments cover a wide range of assets such as private equity, hedge funds, cryptocurrencies, and collectibles. They offer unique opportunities for diversification, potentially higher returns, and low correlation to traditional assets. Alternative investments can enhance the risk-return profile of a portfolio.

Cash and Cash Equivalents

Cash and cash equivalents include savings accounts, money market funds, and certificates of deposit. They provide liquidity, stability, and protection against market volatility. Cash and cash equivalents are essential for emergency funds and short-term financial goals.

Strategies for Building a Diversified Portfolio

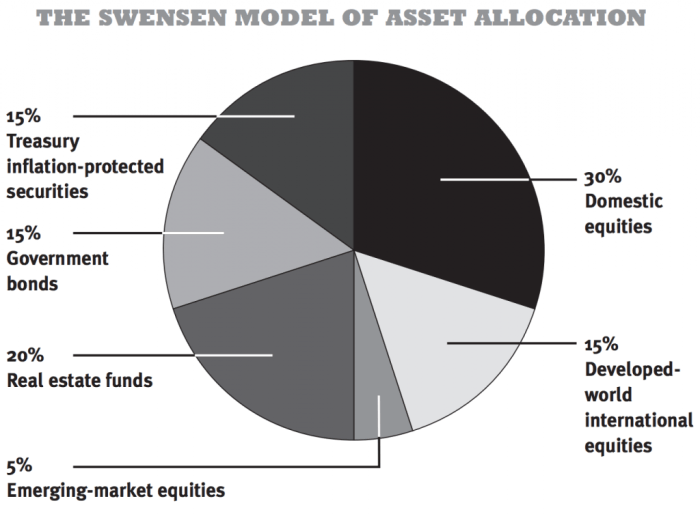

When it comes to building a diversified portfolio, one key strategy to consider is asset allocation. This involves spreading your investments across different asset classes to minimize risk and maximize returns.

Asset Allocation and Diversification

Asset allocation is the process of dividing your investments among different asset classes, such as stocks, bonds, real estate, and cash equivalents. By diversifying your portfolio in this way, you can reduce the impact of volatility in any one asset class on your overall investment performance.

- Allocate investments based on your risk tolerance and investment goals.

- Consider your time horizon when deciding how much to allocate to each asset class.

- Regularly review and rebalance your portfolio to maintain your desired asset allocation.

Passive vs. Active Investment Strategies

When it comes to diversification, you can choose between passive and active investment strategies. Passive strategies involve investing in index funds or ETFs that track a specific market index, while active strategies involve selecting individual securities in an attempt to outperform the market.

- Passive strategies are typically lower cost and require less time and expertise.

- Active strategies may offer the potential for higher returns but come with higher fees and increased risk.

- Consider a combination of both passive and active strategies to achieve optimal diversification.

Risks and Challenges in Diversifying an Investment Portfolio

Diversifying an investment portfolio is crucial for risk management and maximizing returns. However, there are specific risks and challenges that investors may encounter in the process.

Common Risks Associated with Diversified Portfolios

- Diversification may not always protect against market-wide risks, such as economic downturns or geopolitical events that impact all asset classes simultaneously.

- Over-diversification can dilute potential returns, as spreading investments too thin may limit the portfolio’s ability to outperform the market.

- Correlation risk is a concern when assets within the portfolio move in the same direction during market fluctuations, reducing the benefits of diversification.

Challenges in Diversifying Investments

- Identifying the right mix of assets to achieve optimal diversification can be challenging, requiring a deep understanding of different asset classes and their correlation patterns.

- Managing a diversified portfolio effectively requires ongoing monitoring and rebalancing to ensure that the original asset allocation targets are maintained.

- Behavioral biases, such as the fear of missing out or loss aversion, can hinder investors from making rational decisions when diversifying their investments.

Mitigating Risks while Maintaining Diversification

- Regularly review and rebalance the portfolio to adjust for changes in market conditions and ensure that the asset allocation remains aligned with investment goals.

- Consider incorporating uncorrelated assets, such as alternative investments or international securities, to enhance diversification and reduce correlation risk.

- Seek professional advice from financial advisors or portfolio managers to help navigate the complexities of diversifying an investment portfolio and mitigate potential risks effectively.