Benefits of financial planning software sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Financial planning software is like having a cool tool in your back pocket, helping you navigate the complex world of finances with ease and precision. It’s the ultimate hack for individuals and businesses looking to take charge of their financial future.

Importance of Financial Planning Software

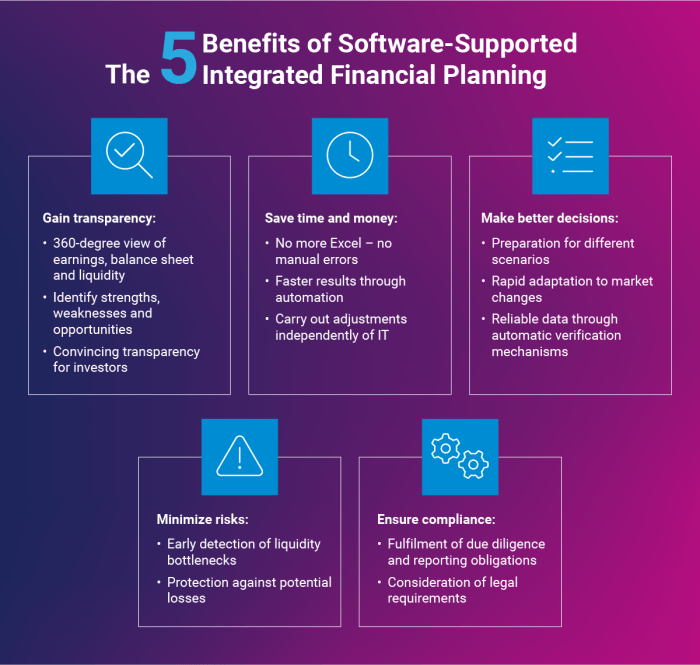

Financial planning software plays a crucial role in helping both individuals and businesses effectively manage their finances. By utilizing this software, users can streamline their financial processes, track expenses, set financial goals, and make informed decisions based on accurate data.

Benefits of Using Financial Planning Software

- Efficient Budgeting: Financial planning software enables users to create detailed budgets, track spending patterns, and identify areas where they can cut costs or reallocate funds.

- Accurate Forecasting: With the help of financial planning software, individuals and businesses can generate accurate forecasts based on historical data, market trends, and future goals. This allows for better decision-making and planning for the future.

- Goal Setting: By using financial planning software, users can set specific financial goals, such as saving for retirement, buying a house, or starting a business. The software can track progress towards these goals and provide insights on how to achieve them effectively.

- Financial Analysis: Financial planning software offers tools for analyzing financial data, generating reports, and identifying areas for improvement. This helps users gain a better understanding of their financial health and make informed decisions for long-term success.

Features of Financial Planning Software

When it comes to financial planning software, there are several key features that can help individuals and businesses manage their finances effectively. From budgeting tools to investment trackers, these features play a crucial role in ensuring financial stability and growth.

Automation for Simplified Financial Tasks

Financial planning software often comes equipped with automation features that streamline various financial tasks. This includes automatic bill payment reminders, scheduled fund transfers, and even investment rebalancing. By automating these processes, users can save time and reduce the risk of human error, ultimately leading to more efficient financial management.

Integration with Bank Accounts for Expense Tracking

One of the standout features of financial planning software is its ability to integrate with bank accounts. This integration allows users to track their expenses in real-time, categorize transactions, and generate detailed reports on their spending habits. By having a clear overview of their financial activities, individuals can make informed decisions and adjust their budget accordingly.

Efficiency and Time Savings

Using financial planning software can significantly save time compared to manual methods. The automation provided by these tools streamlines financial processes, resulting in increased efficiency and productivity.

Automation of Routine Tasks

Financial planning software automates routine tasks such as data entry, calculations, and report generation. This automation eliminates the need for manual input and reduces the risk of errors, saving valuable time for financial professionals.

Real-Time Data Updates

One key efficiency gain achieved by utilizing software for financial planning is the ability to access real-time data updates. This ensures that financial plans are always based on the most current information, allowing for quicker decision-making and adjustments.

Scenario Modeling and Analysis

Financial planning software enables users to create and analyze various scenarios quickly. By inputting different variables and assumptions, professionals can assess the impact on financial outcomes efficiently. This capability helps in making informed decisions without the need for manual calculations.

Integration with Other Systems

Another time-saving feature of financial planning software is its ability to integrate with other systems such as accounting software or CRM platforms. This seamless integration streamlines data flow and eliminates the need for manual data entry across multiple platforms.

Automated Reporting

Financial planning software automates report generation, allowing for the quick creation of customized reports for clients or internal use. This feature saves time on manual report preparation and ensures consistency in reporting formats.

Accuracy and Error Reduction

Financial planning software plays a crucial role in minimizing errors and ensuring data accuracy in financial records. By automating calculations and updates, these tools help users maintain precise and reliable financial information, leading to more informed decision-making and strategic planning.

Minimizing Errors in Calculations

- Financial planning software eliminates the risk of human error in calculations, reducing the chances of inaccuracies in budgeting, forecasting, and investment analysis.

- Automated features and built-in formulas help users perform complex financial calculations with speed and accuracy, saving time and effort in manual data entry.

- By providing real-time data updates and syncing information across multiple financial accounts, software minimizes discrepancies and ensures consistency in financial reports.

Importance of Accuracy in Financial Planning

- Accurate financial data is essential for making well-informed decisions, setting realistic goals, and tracking progress towards financial objectives.

- Errors in financial calculations can lead to incorrect budgeting, forecasting, and investment strategies, potentially resulting in financial losses or missed opportunities.

- Financial planning software helps users maintain precision in their financial records, enabling them to analyze trends, identify patterns, and adjust their plans accordingly for better financial outcomes.

Collaboration and Accessibility

Financial planning software plays a crucial role in promoting collaboration among team members or family, enhancing accessibility to financial data, and enabling secure sharing of financial information.

Facilitating Collaboration

Financial planning software allows team members or family to work together seamlessly on financial goals and budgets. It provides real-time updates and shared access to financial information, fostering better communication and coordination among users.

Cloud-Based Accessibility

One of the key benefits of financial planning software is the ability to access financial data from anywhere, anytime. With cloud-based solutions, users can log in from different devices and locations, ensuring that important financial information is always at their fingertips.

Secure Financial Information Sharing

Financial planning software offers secure ways to share financial information with team members or family members. By setting permissions and access levels, users can control who sees what data, ensuring that sensitive information remains confidential and protected.