Get ready to dive into the world of investment vehicles with a fresh perspective. Buckle up as we explore the ins and outs of stocks, bonds, mutual funds, and ETFs, comparing and contrasting their unique features.

In this guide, we will unravel the complexities of various investment options, shedding light on factors that impact your investment decisions and demystifying performance metrics that help you gauge success.

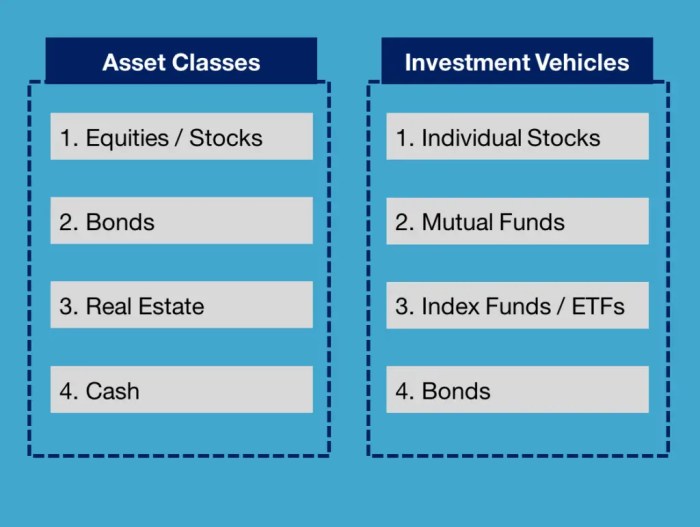

Types of Investment Vehicles

Investing in different vehicles can help diversify your portfolio and manage risk. Let’s compare and contrast stocks, bonds, mutual funds, and ETFs to understand their characteristics and associated risks.

Stocks

Stocks represent ownership in a company and can offer potential for high returns, but they also come with high volatility. Examples include Apple (AAPL) and Amazon (AMZN). Risks include market fluctuations and company-specific risks.

Bonds

Bonds are debt securities issued by governments or corporations. They provide regular interest payments and return of principal at maturity. Examples include U.S. Treasury bonds and corporate bonds. Risks include interest rate changes and credit risk.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Examples include Vanguard Total Stock Market Index Fund and Fidelity Total Bond Fund. Risks include market risk and fund manager risk.

ETFs

ETFs are similar to mutual funds but trade on an exchange like a stock. They offer diversification and can be bought and sold throughout the trading day. Examples include SPDR S&P 500 ETF (SPY) and Invesco QQQ Trust (QQQ). Risks include market risk and tracking error.

Factors to Consider When Choosing an Investment Vehicle

When it comes to choosing an investment vehicle, there are several key factors to consider that can greatly impact your financial success. Let’s dive into some of the most important considerations.

Importance of Risk Tolerance

Understanding your risk tolerance is crucial when selecting an investment vehicle. Risk tolerance refers to how much volatility and uncertainty you are willing to endure in your investments. If you have a low risk tolerance, you may opt for safer, more conservative investment options like bonds or certificates of deposit. On the other hand, if you have a high risk tolerance, you might be more inclined to invest in stocks or real estate, which have the potential for higher returns but also come with greater risk.

Impact of Investment Goals and Time Horizon

Your investment goals and time horizon play a significant role in determining the most suitable investment vehicle for you. If you have long-term goals, such as saving for retirement, you may be able to afford more risk in your investments and benefit from the higher potential returns offered by stocks. Conversely, if you have short-term goals, like saving for a down payment on a house in the next few years, you may want to prioritize preserving your capital and choose more stable, low-risk investments.

Comparison of Liquidity in Investment Vehicles

Liquidity refers to how easily an investment can be converted into cash without significantly affecting its price. Different investment vehicles offer varying levels of liquidity. For example, stocks and mutual funds are generally highly liquid, as they can be bought and sold quickly on the stock market. On the other hand, real estate and certain types of bonds may have lower liquidity, as they may take longer to sell and could incur transaction costs. It’s important to consider the liquidity of an investment vehicle based on your financial needs and ability to access your funds quickly when necessary.

Performance Metrics for Investment Vehicles

When evaluating the performance of investment vehicles, it’s crucial to analyze various performance metrics to make informed decisions about your investments. Understanding the historical performance, expenses, fees, and benchmarks of stocks, bonds, mutual funds, and ETFs can help you assess their potential returns and risks.

Analyzing Historical Performance

Historical performance data provides valuable insights into how an investment has performed over time. It allows investors to assess the volatility, returns, and overall stability of an investment vehicle. When analyzing historical performance, consider factors such as annual returns, price fluctuations, and any major events that may have impacted the investment’s performance.

Role of Expenses and Fees

Expenses and fees play a significant role in determining the overall performance of an investment vehicle. High fees can eat into your returns, reducing the overall profitability of your investment. It’s essential to consider all costs associated with an investment, including management fees, transaction costs, and other expenses, to accurately evaluate its performance.

Comparing with Benchmarks

Using benchmarks is a common way to assess the performance of different investment vehicles. Benchmarks are used as a reference point to compare the returns of an investment against a specific market index or industry standard. By comparing the performance of an investment with a relevant benchmark, investors can gain insight into how well the investment has performed relative to its peers and the overall market.

Tax Implications of Various Investment Vehicles

Investing in different vehicles can have varying tax implications that can impact your overall returns. It’s important to understand how stocks, bonds, mutual funds, and ETFs are taxed differently to make informed decisions about your investments.

Tax Treatment of Stocks, Bonds, Mutual Funds, and ETFs

When it comes to stocks, you may incur capital gains taxes when you sell shares for a profit. Dividends received from stocks are also subject to taxes. Bonds can generate interest income that is taxable at your ordinary income tax rate. Mutual funds can distribute capital gains and dividends to investors, which are taxed accordingly. ETFs are similar to stocks in terms of tax treatment, where capital gains and dividends are taxable.

Tax Efficiency in Investment Vehicles

Tax efficiency refers to the ability of an investment vehicle to minimize the tax impact on your returns. Some investment vehicles, like ETFs, are known for their tax efficiency because of their structure that allows for lower capital gains distributions. Mutual funds, on the other hand, can be less tax-efficient due to frequent portfolio turnover and capital gains distributions.

Strategies for Optimizing Tax Advantages

One strategy for optimizing tax advantages is to hold tax-inefficient investments in tax-advantaged accounts like IRAs or 401(k)s. This can help defer taxes on distributions until retirement. Another strategy is to prioritize tax-efficient investments in taxable accounts to minimize the tax burden on investment returns. Additionally, consider tax-loss harvesting to offset capital gains with capital losses in your portfolio.