Diving deep into the realm of Types of life insurance, this introduction sets the stage for an enlightening exploration that will leave readers informed and intrigued.

Get ready to uncover the nuances and intricacies of different life insurance options that can shape your financial future.

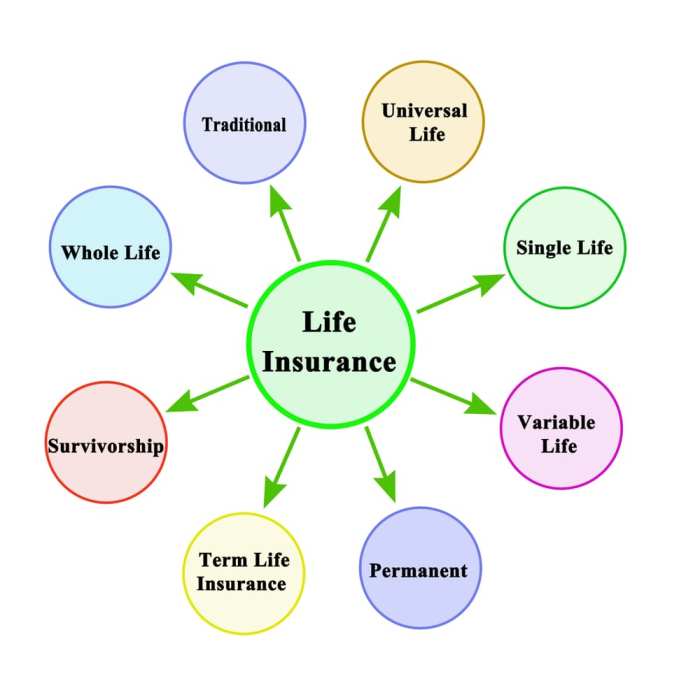

Types of Life Insurance

Life insurance comes in various forms to suit different needs and preferences. Let’s delve into the details of term life insurance, whole life insurance vs. universal life insurance, and the differences between permanent life insurance and variable life insurance.

Term Life Insurance

Term life insurance provides coverage for a specific period, usually ranging from 10 to 30 years. It offers a death benefit to the beneficiaries if the insured passes away during the term of the policy. This type of insurance is typically more affordable than permanent life insurance, making it a popular choice for those looking for basic coverage.

Whole Life Insurance vs. Universal Life Insurance

Whole life insurance provides coverage for the entire lifetime of the insured, as long as premiums are paid. It also includes a cash value component that grows over time. On the other hand, universal life insurance offers more flexibility in terms of premium payments and coverage amounts. It allows policyholders to adjust their premiums and death benefits to suit their changing needs.

Permanent Life Insurance vs. Variable Life Insurance

Permanent life insurance, such as whole life and universal life insurance, provides coverage for life and includes a cash value component. This cash value grows over time on a tax-deferred basis. In contrast, variable life insurance allows policyholders to allocate their premiums among different investment options, such as stocks and bonds. The cash value and death benefit can vary based on the performance of these investments.

Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, usually ranging from 5 to 30 years. It is designed to provide financial protection for your loved ones in case of your untimely death during the term of the policy.

Characteristics of Term Life Insurance

- Provides coverage for a specific period

- Lower premiums compared to whole life insurance

- No cash value accumulation

- Renewable and convertible options available

Situations Where Term Life Insurance is Suitable

- Young families with limited budget looking for affordable coverage

- Individuals with temporary financial obligations like mortgages or loans

- Business owners seeking coverage for a specific business term

Pros and Cons of Term Life Insurance

- Pros:

- Lower premiums make it more affordable

- Flexibility to choose coverage term based on specific needs

- Simple and straightforward coverage

- Cons:

- No cash value accumulation like whole life insurance

- Premiums can increase significantly upon policy renewal

- Does not provide coverage for the entire lifetime

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the insured individual. Unlike term life insurance, which only covers a specific period, whole life insurance offers a death benefit as well as a cash value component that grows over time.

Features of Whole Life Insurance

- Guaranteed death benefit

- Fixed premiums

- Cash value accumulation

- Policy dividends

Benefits of Whole Life Insurance for Long-Term Financial Planning

- Provides lifetime coverage

- Can be used as a source of tax-free income

- Builds cash value over time

- Offers financial security for loved ones

Comparison of Whole Life Insurance to Other Investment Options

- Stability and guaranteed returns compared to market risks in stocks

- Tax advantages in terms of cash value growth and death benefit payouts

- Ability to borrow against cash value at reasonable interest rates

- Less volatile compared to other investment vehicles like mutual funds

Universal Life Insurance

Universal life insurance is a type of permanent life insurance that offers both a death benefit and a savings component. Unlike whole life insurance, universal life insurance provides more flexibility in terms of premiums and death benefits.

How Universal Life Insurance Works

Universal life insurance allows policyholders to adjust their premium payments and death benefits throughout the life of the policy. The policy accumulates cash value over time, which can be used to cover premiums or withdrawn by the policyholder.

Flexibility of Premiums and Death Benefits

- Policyholders can choose to pay higher or lower premiums, as long as the policy has enough cash value to cover the costs.

- Death benefits can be adjusted to meet the changing needs of the policyholder, such as increasing coverage for a growing family or decreasing coverage as financial responsibilities lessen.

- The cash value in a universal life insurance policy can grow at a variable interest rate, allowing for potential higher returns compared to traditional whole life insurance.

Advantages and Disadvantages of Universal Life Insurance

- Advantages:

Flexibility in premium payments and death benefits.

Potential for higher returns on cash value compared to whole life insurance.

- Disadvantages:

Complexity in understanding the policy and its components.

Policy performance may be affected by changes in interest rates or market conditions.