Get ready to dive into the world of investment portfolios with this guide that’s packed with essential tips and strategies. Whether you’re a newbie or looking to fine-tune your portfolio, this article will equip you with the knowledge needed to make informed decisions and maximize returns.

From understanding the basics of asset allocation to mastering risk management techniques, this comprehensive overview will help you build a solid foundation for your investment journey.

Understanding Investment Portfolios

Investment portfolios are collections of different financial assets such as stocks, bonds, real estate, and commodities that an individual or institution holds to achieve specific financial goals.

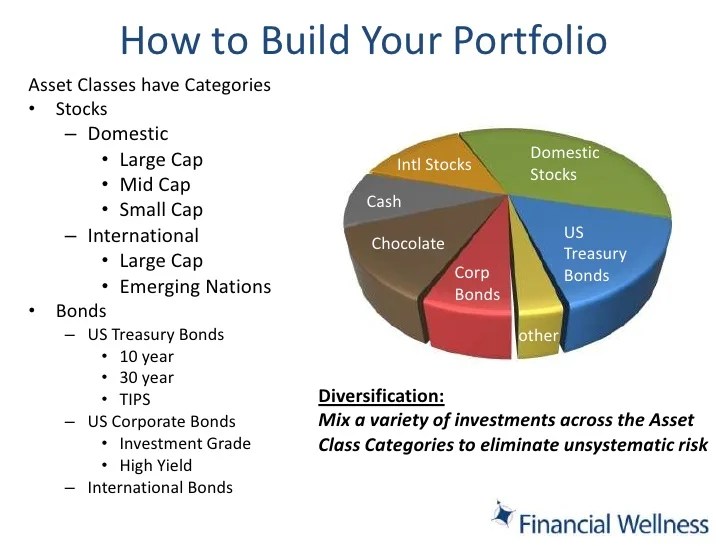

Diversification is crucial in an investment portfolio because it helps spread risk by investing in a variety of assets. This way, if one investment performs poorly, it may be offset by another that performs well.

Types of Assets in a Portfolio

- Stocks: Represent ownership in a company and offer potential for high returns but come with higher risk.

- Bonds: Debt securities issued by governments or corporations, offering regular interest payments and lower risk compared to stocks.

- Real Estate: Includes properties such as residential, commercial, or industrial real estate that can provide rental income and appreciation.

- Commodities: Raw materials such as gold, silver, oil, and agricultural products that can act as a hedge against inflation.

Investment Portfolio Strategies

- Conservative Portfolio: Focuses on capital preservation and income generation with a higher allocation to bonds and cash.

- Aggressive Portfolio: Seeks higher returns through a larger allocation to stocks and alternative investments with higher risk.

- Income Portfolio: Emphasizes investments that generate regular income such as dividend-paying stocks and bonds.

- Growth Portfolio: Aims for capital appreciation by investing in growth stocks and assets with higher potential for returns over the long term.

Setting Investment Goals

When building an investment portfolio, it is crucial to first determine your financial goals. These goals will serve as a roadmap to guide your investment decisions and help you stay focused on what you want to achieve in the long run.

Importance of Setting Investment Goals

Setting clear and specific investment goals is essential for several reasons. It helps you define the purpose of your investments, whether it’s to save for retirement, purchase a home, fund your child’s education, or achieve financial independence. Without clear goals, you may find yourself making impulsive investment decisions that could derail your long-term financial plans.

- Setting a Timeline: One of the key aspects of setting investment goals is establishing a timeline for achieving them. Whether you have short-term goals (within 1-3 years), medium-term goals (3-5 years), or long-term goals (5+ years), having a timeline helps you determine the appropriate investment strategy and risk tolerance.

- Risk Tolerance: Your risk tolerance plays a significant role in shaping your investment decisions. It refers to your willingness and ability to endure fluctuations in the value of your investments. Understanding your risk tolerance is crucial in determining the mix of investments in your portfolio, balancing potential returns with the level of risk you are comfortable with.

- Adjusting Goals: As your financial situation and life circumstances change, it’s important to periodically review and adjust your investment goals. This flexibility allows you to adapt your portfolio to meet new objectives or address unexpected challenges along the way.

Asset Allocation Strategies

When it comes to building an investment portfolio, one of the key elements to consider is asset allocation. Asset allocation refers to how you divide your investments among different asset classes like stocks, bonds, and real estate. This is crucial because it helps manage risk and optimize returns based on your risk tolerance and investment goals.

Different Asset Classes and Their Role

- Stocks: Stocks represent ownership in a company and have the potential for high returns but also come with higher risks. They are typically suitable for long-term growth objectives.

- Bonds: Bonds are debt securities issued by companies or governments. They provide regular interest payments and are considered less risky than stocks, making them ideal for income generation and capital preservation.

- Real Estate: Real estate investments involve properties like residential, commercial, or industrial real estate. They offer diversification benefits and can provide a steady income stream through rent payments.

Guidelines for Asset Allocation

- Assess Risk Tolerance: Determine how much risk you are willing to take and align your asset allocation accordingly. Younger investors with a longer time horizon can typically afford to take more risks and invest a higher percentage in stocks.

- Consider Investment Goals: Your investment goals, whether it’s building wealth, generating income, or capital preservation, should guide your asset allocation decisions. For example, if you are nearing retirement, you may want to shift towards more conservative investments.

- Diversify Your Portfolio: Spread your investments across different asset classes to reduce risk. Diversification helps minimize the impact of a decline in one asset class on your overall portfolio.

- Regularly Rebalance: Monitor your portfolio regularly and rebalance it to maintain your target asset allocation. This involves selling overperforming assets and buying underperforming ones to bring your portfolio back in line with your goals.

Risk Management Techniques

When it comes to building an investment portfolio, managing risk is crucial. By implementing effective risk management techniques, investors can protect their investments and potentially increase their returns. Understanding the relationship between risk and return, utilizing diversification, and employing hedging strategies are key components of risk management in investment portfolios.

Relationship Between Risk and Return

The relationship between risk and return is fundamental in investment decisions. In general, higher returns are associated with higher levels of risk. Investors must carefully assess their risk tolerance and investment goals to determine the appropriate level of risk for their portfolio. Balancing risk and return is essential for achieving long-term financial objectives.

Diversification for Risk Reduction

Diversification is a strategy that involves spreading investments across different asset classes, industries, and geographic regions. By diversifying their portfolio, investors can reduce the impact of volatility in any single investment. This helps to minimize the overall risk of the portfolio and potentially enhance returns. For example, an investor may hold a mix of stocks, bonds, and real estate to achieve diversification.

Hedging Strategies for Protection

Hedging is a risk management technique that involves taking opposing positions to offset potential losses in investments. One common hedging strategy is using options contracts to protect against adverse price movements. For instance, an investor holding a large position in a specific stock may purchase put options to limit losses if the stock price declines. Hedging strategies can help safeguard investments during market downturns or unexpected events.

Monitoring and Rebalancing

Regularly monitoring an investment portfolio is crucial to ensure that it aligns with your financial goals and risk tolerance. By keeping a close eye on your investments, you can make informed decisions and adjustments as needed to optimize performance and manage risks effectively.

Rebalancing a portfolio becomes necessary when the asset allocation deviates significantly from your target allocation. This could happen due to market fluctuations or changes in your financial situation. By rebalancing, you realign your portfolio to maintain the desired risk-return profile.

Importance of Tracking Portfolio Performance

Tracking portfolio performance allows you to evaluate the effectiveness of your investment strategy and make adjustments accordingly. It helps you identify underperforming assets or sectors that may need to be replaced or rebalanced.

- Utilize online tools and software to track the performance of your investments in real-time.

- Regularly review your portfolio against benchmark indices to gauge performance relative to the market.

- Consider using spreadsheets or investment tracking apps to maintain a detailed record of your holdings and transactions.

Step-by-Step Guide to Rebalancing a Portfolio

- Evaluate your current asset allocation and compare it to your target allocation.

- Identify which asset classes are over or underweighted based on your investment goals.

- Determine the trades needed to realign your portfolio, considering transaction costs and tax implications.

- Execute the trades to rebalance your portfolio back to your desired asset allocation.

- Monitor the performance of your rebalanced portfolio and make adjustments as necessary.