Yo, peep this! How to read financial statements is about to drop some serious knowledge bombs on you. Get ready to dive into the world of financial statements and learn how to decode them like a pro.

Now, let’s break it down for you – starting with an intro to financial statements and why they’re crucial for understanding a company’s financial health.

Introduction to Financial Statements

Financial statements are crucial documents that provide a snapshot of a company’s financial performance and position. They are essential tools for investors, creditors, and other stakeholders to assess the financial health of a business.

Types of Financial Statements

- Income Statement: This statement shows a company’s revenue, expenses, and profits over a specific period, typically quarterly or annually.

- Balance Sheet: The balance sheet provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time, giving insight into its financial position.

- Cash Flow Statement: This statement details the cash inflows and outflows of a company, showing how cash is generated and used during a specific period.

The income statement helps investors understand the profitability of a company, while the balance sheet gives insights into its financial position and liquidity. The cash flow statement shows how efficiently a company manages its cash flows, ensuring sustainability.

Understanding the Income Statement

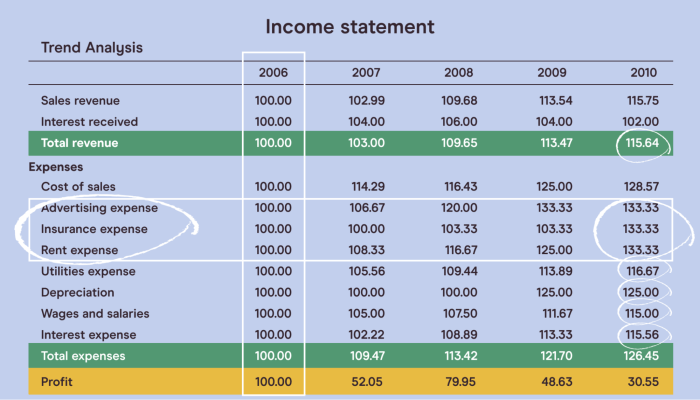

The income statement is a financial document that shows a company’s revenues, expenses, and net income over a specific period of time. It provides valuable insights into a company’s profitability and financial performance.

Key Components of the Income Statement

- Revenue: This represents the total amount of money generated from sales of goods or services. It is a crucial indicator of a company’s ability to generate income.

- Expenses: These are the costs incurred by the company to generate revenue. Expenses can include salaries, rent, utilities, and other operating costs.

- Net Income: Also known as the bottom line, net income is the total revenue minus total expenses. It shows how profitable a company is after all expenses have been accounted for.

Analyzing Revenue Trends

- It is essential to analyze revenue trends over time to understand how a company’s sales are growing or declining.

- Look for consistent growth or any sudden drops in revenue, as these could indicate changes in market demand, pricing strategies, or other factors affecting sales.

- Identify any irregularities in revenue patterns and investigate the reasons behind them to make informed decisions about the company’s financial health.

Earnings Before Interest and Taxes (EBIT)

- EBIT is a measure of a company’s operating profitability before interest and taxes are taken into account.

- It is calculated by subtracting operating expenses from gross profit, providing a clearer view of a company’s core profitability.

- EBIT is significant as it helps investors and analysts assess a company’s operational efficiency and compare its performance with competitors in the industry.

Decoding the Balance Sheet

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It consists of three main components: assets, liabilities, and equity. Assets represent what the company owns, liabilities are what it owes, and equity is the difference between the two.

Calculating Important Ratios

To calculate important ratios like the current ratio and debt-to-equity ratio using balance sheet data, you can use the following formulas:

- The current ratio is calculated by dividing current assets by current liabilities. It measures a company’s ability to cover its short-term liabilities with its short-term assets.

- The debt-to-equity ratio is calculated by dividing total liabilities by total equity. It shows the proportion of debt a company is using to finance its assets compared to equity.

Analyzing Working Capital

Working capital is calculated by subtracting current liabilities from current assets. It represents the amount of liquid assets available to a company for day-to-day operations. Analyzing working capital is crucial as it indicates a company’s short-term financial health. A positive working capital is generally a good sign, as it means the company has enough current assets to cover its short-term liabilities.

Interpreting the Cash Flow Statement

Understanding the cash flow statement is crucial in assessing a company’s financial health. This statement provides insights into how cash is being generated and used by the business.

Sections of the Cash Flow Statement

The cash flow statement is divided into three main sections:

- Operating Activities: This section includes cash flows from the company’s primary business activities, such as sales and expenses.

- Investing Activities: Here, cash flows related to the purchase or sale of assets like equipment or investments are recorded.

- Financing Activities: This section covers cash flows from activities like issuing stock, repurchasing shares, or paying dividends.

Cash Flow from Operations vs. Net Income

While net income is the profitability of a company, cash flow from operations shows the actual cash generated from core business activities. The key difference lies in the fact that net income includes non-cash items like depreciation, whereas cash flow from operations focuses on actual cash movements.

Importance of Cash Flow Analysis

Cash flow analysis is essential for evaluating a company’s liquidity and financial stability. It helps in understanding how effectively a company is managing its cash resources and whether it can meet its financial obligations. By examining the cash flow statement, investors can gain valuable insights into a company’s ability to generate cash and sustain its operations.

Ratios and Financial Analysis

Financial ratios are key tools used to evaluate a company’s performance and financial health. By analyzing these ratios, investors, analysts, and stakeholders can gain insights into various aspects of a company’s operations and make informed decisions.

Profitability Ratios

Profitability ratios measure a company’s ability to generate profit relative to its revenue, assets, or equity. Some common profitability ratios include:

- Gross Profit Margin:

(Gross Profit / Revenue) x 100%

- Net Profit Margin:

(Net Income / Revenue) x 100%

- Return on Assets (ROA):

(Net Income / Average Total Assets)

- Return on Equity (ROE):

(Net Income / Average Shareholders’ Equity)

Liquidity Ratios

Liquidity ratios assess a company’s ability to meet its short-term financial obligations. These ratios indicate the company’s liquidity and financial flexibility. Some common liquidity ratios include:

- Current Ratio:

Current Assets / Current Liabilities

- Quick Ratio:

(Current Assets – Inventory) / Current Liabilities

- Cash Ratio:

(Cash and Cash Equivalents) / Current Liabilities

Solvency Ratios

Solvency ratios evaluate a company’s long-term financial stability and ability to meet its long-term obligations. These ratios provide insights into the company’s leverage and financial risk. Some common solvency ratios include:

- Debt-to-Equity Ratio:

Total Debt / Total Equity

- Interest Coverage Ratio:

EBIT / Interest Expense

- Debt Ratio:

Total Debt / Total Assets

Common Mistakes to Avoid

When it comes to reading financial statements, there are several common mistakes that can lead to misinterpretation of data and flawed analysis. It is essential to be aware of these errors to make informed decisions based on accurate financial information.

Overlooking Footnotes and Disclosures

One common mistake is overlooking the footnotes and disclosures in financial statements. These sections provide important details and explanations that are crucial for understanding the numbers presented in the statements. Ignoring this information can lead to misinterpretation and incorrect analysis.

Only Focusing on Profitability

Another mistake is only focusing on profitability when analyzing financial statements. While profitability is important, it is not the only indicator of a company’s financial health. It is essential to consider other factors such as liquidity, solvency, and efficiency to get a complete picture of the company’s financial position.

Ignoring Changes in Accounting Methods

Ignoring changes in accounting methods can also lead to misinterpretation of financial data. Companies may change their accounting methods, which can impact the numbers presented in the financial statements. It is crucial to be aware of these changes and adjust the analysis accordingly.

Relying Solely on Ratios

Ratios are valuable tools for financial analysis, but relying solely on ratios can be a mistake. It is important to look at the context in which the ratios are calculated and consider other factors to make informed decisions. Using ratios without understanding the underlying data can result in flawed analysis.

Real-World Examples and Case Studies

Understanding how financial statements are utilized in real-world scenarios is crucial for making informed business decisions. By analyzing case studies of companies’ financial statements, we can grasp key concepts and gain valuable insights into their financial health.

Example 1: Tech Industry vs. Healthcare Industry

Let’s compare how financial statements differ between the tech industry and the healthcare industry:

- Tech Industry: Companies like Apple or Microsoft often have high R&D expenses reflected in their income statements, indicating a focus on innovation.

- Healthcare Industry: Companies like Pfizer or Johnson & Johnson may have significant liabilities related to clinical trials and regulatory compliance, impacting their balance sheets.

Case Study: Amazon

Amazon’s financial statements provide valuable insights into its growth strategy and operational efficiency:

- Income Statement: Amazon’s increasing revenue and expanding profit margins showcase its successful e-commerce and cloud services businesses.

- Balance Sheet: The company’s strong cash position and manageable debt levels indicate financial stability and flexibility for future investments.

- Cash Flow Statement: Analyzing Amazon’s operating cash flow can reveal how efficiently it manages working capital and generates free cash flow.

Key Metrics in Retail Industry

When analyzing financial statements in the retail sector, certain key metrics play a crucial role:

- Inventory Turnover Ratio: This metric helps assess how quickly a company sells its inventory and manages its stock levels.

- Profit Margin: Calculating the profit margin can indicate the company’s pricing strategy and cost management efficiency.

- Return on Assets (ROA): ROA measures how effectively a company utilizes its assets to generate profits, providing insights into operational efficiency.