Yo, diving into the world of Budgeting techniques, we’re about to break it down for you in a way that’s gonna make your financial game strong. Get ready to level up with some mad budgeting skills!

Now, let’s get down to business and explore the ins and outs of budgeting techniques to help you secure that bag.

Importance of Budgeting Techniques

Effective budgeting techniques play a crucial role in both personal and business financial management. By creating a budget and sticking to it, individuals and organizations can better control their spending, save for future goals, and avoid falling into debt.

Financial Stability

- One significant benefit of using budgeting techniques is the ability to achieve financial stability. By tracking income and expenses, individuals can ensure that they are not spending more than they earn.

- Setting aside a portion of income for savings and emergencies helps build a financial cushion, providing peace of mind during unexpected financial challenges.

- With a clear budget in place, individuals can prioritize their spending on essentials while also allocating funds for long-term goals such as buying a home or retiring comfortably.

Impact of Not Using Budgeting Techniques

- On the flip side, not utilizing budgeting techniques can lead to financial instability and unnecessary stress. Without a budget, individuals may overspend, accumulate debt, and struggle to make ends meet.

- Failure to plan and track expenses can result in missed bill payments, late fees, and a lack of savings for emergencies. This can ultimately hinder financial growth and limit opportunities for achieving financial goals.

- Additionally, without a budget, it becomes challenging to identify areas where spending can be reduced or optimized, leading to a cycle of financial uncertainty and missed opportunities for building wealth.

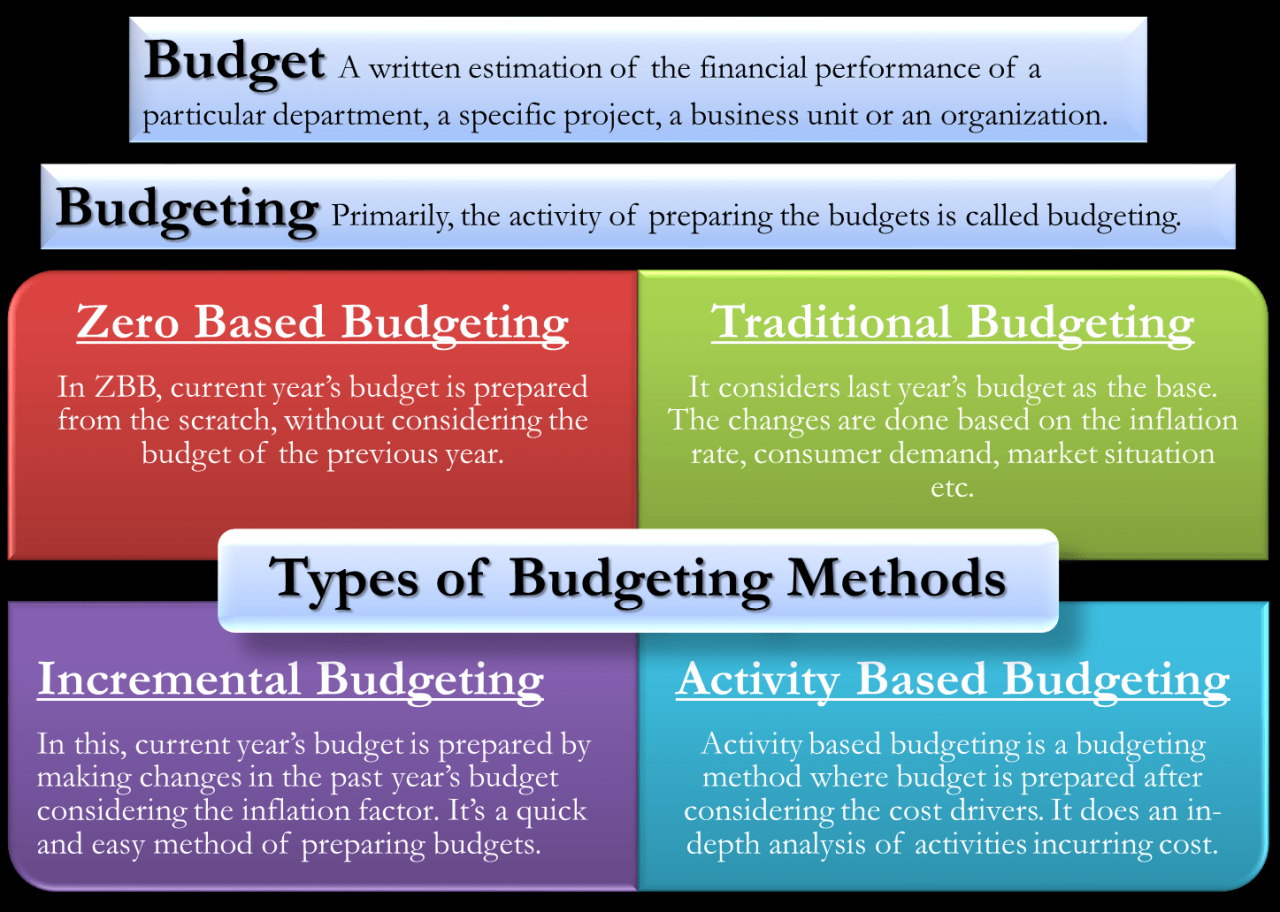

Types of Budgeting Techniques

Budgeting techniques play a crucial role in managing finances effectively. Different types of budgeting techniques are used depending on the financial situation. Let’s explore some common budgeting techniques and compare them based on their suitability for different scenarios.

Zero-Based Budgeting

Zero-based budgeting is a method where each expense must be justified for each new budgeting period. This technique starts from scratch, assuming zero expenses and requires every expense to be justified. It is ideal for businesses looking to cut costs and allocate resources efficiently. For example, companies like Unilever and Coca-Cola have successfully implemented zero-based budgeting to streamline their expenses and improve profitability.

Incremental Budgeting

Incremental budgeting involves making small adjustments to the previous budget based on changes in expenses or revenues. This technique is commonly used in organizations where expenses remain relatively stable. It is suitable for situations where the budgeting process is routine and requires minimal changes. For instance, government agencies often use incremental budgeting to plan their annual budgets.

Activity-Based Budgeting

Activity-based budgeting focuses on the costs of activities and the resources required to perform them. This technique assigns costs based on the activities that drive costs within an organization. It is useful for companies with diverse products or services and helps in identifying the most profitable activities. For example, manufacturing companies like Toyota use activity-based budgeting to allocate resources efficiently and improve productivity.

Flexible Budgeting

Flexible budgeting adjusts the budget based on changes in activity levels or other variables. This technique allows for more accurate forecasting by adapting to changes in the business environment. It is suitable for industries with variable sales or production levels, such as retail or seasonal businesses. For example, clothing retailers like Zara use flexible budgeting to adjust their budgets based on changing consumer demand and market trends.

Steps to Implement Budgeting Techniques

Implementing budgeting techniques can be a game-changer when it comes to managing your finances effectively. Here are the step-by-step processes to get you started:

Setting Realistic Financial Goals

- Start by assessing your current financial situation, including income, expenses, debt, and savings.

- Identify short-term and long-term financial goals that are specific, measurable, achievable, relevant, and time-bound (SMART goals).

- Break down your goals into smaller milestones to track your progress effectively.

Implementing the Budgeting Technique

- Choose a budgeting method that aligns with your financial goals and preferences, such as zero-based budgeting, envelope system, or 50/30/20 rule.

- List all your sources of income and categorize your expenses, including fixed costs (rent, utilities) and variable costs (entertainment, dining out).

- Set limits for each spending category based on your financial goals and priorities.

- Track your expenses regularly using budgeting tools or apps to ensure you stay within your budget limits.

Challenges in Adopting Budgeting Techniques

- Resistance to change: It can be challenging to adjust to a new way of managing finances, especially if you are used to a more relaxed approach.

- Unexpected expenses: Emergencies or unplanned costs can disrupt your budgeting efforts, requiring flexibility and adaptability.

- Lack of discipline: Sticking to a budget requires consistency and self-control, which can be difficult for some individuals.

Tools and Resources for Budgeting

Budgeting tools and resources play a crucial role in helping individuals and businesses effectively manage their finances. With the advancement of technology, there are now numerous tools and software available to simplify the budgeting process and provide valuable insights for financial planning.

Popular Tools and Software for Budgeting

There are several popular tools and software designed specifically for budgeting purposes:

- Mint: A popular budgeting app that allows users to track their spending, create budgets, and receive alerts for upcoming bills.

- You Need a Budget (YNAB): An application that focuses on zero-based budgeting, where every dollar is allocated to a specific category.

- Personal Capital: A tool that not only helps with budgeting but also offers investment tracking and retirement planning features.

- Quicken: A comprehensive financial software that includes budgeting, bill management, and investment tracking capabilities.

Revolutionizing Budgeting Techniques with Technology

Technology has revolutionized the way budgeting techniques can be utilized by providing real-time data, automation, and customization options:

- Automation features in budgeting software can categorize expenses, track income, and provide insights into spending patterns.

- Mobile apps allow users to access their budgeting tools on the go, making it easier to stay on top of finances.

- Integration with bank accounts and credit cards enables automatic transaction syncing, reducing manual data entry.

Utilizing Budgeting Resources for Long-term Financial Planning

Effective utilization of budgeting resources is essential for long-term financial planning and stability:

- Regularly review and update your budget to reflect changing financial goals and priorities.

- Use budgeting tools to analyze spending habits, identify areas for improvement, and set achievable financial milestones.

- Utilize budgeting software features like goal tracking and debt payoff calculators to stay motivated and on track with your financial objectives.